A debit card can go by a few names including; debit card, payment card, payroll card and an ATM card.

The Suits Me® debit card is a contactless Mastercard® Debit card and can be used in over 24 million places worldwide. To read more about our debit cards, visit our debit card information page.

Debit Card Features and Functions

Whether you are taking money out at an ATM, shopping on the high street, online or over the phone, understanding the parts of your debit card and their functions can prove very handy.

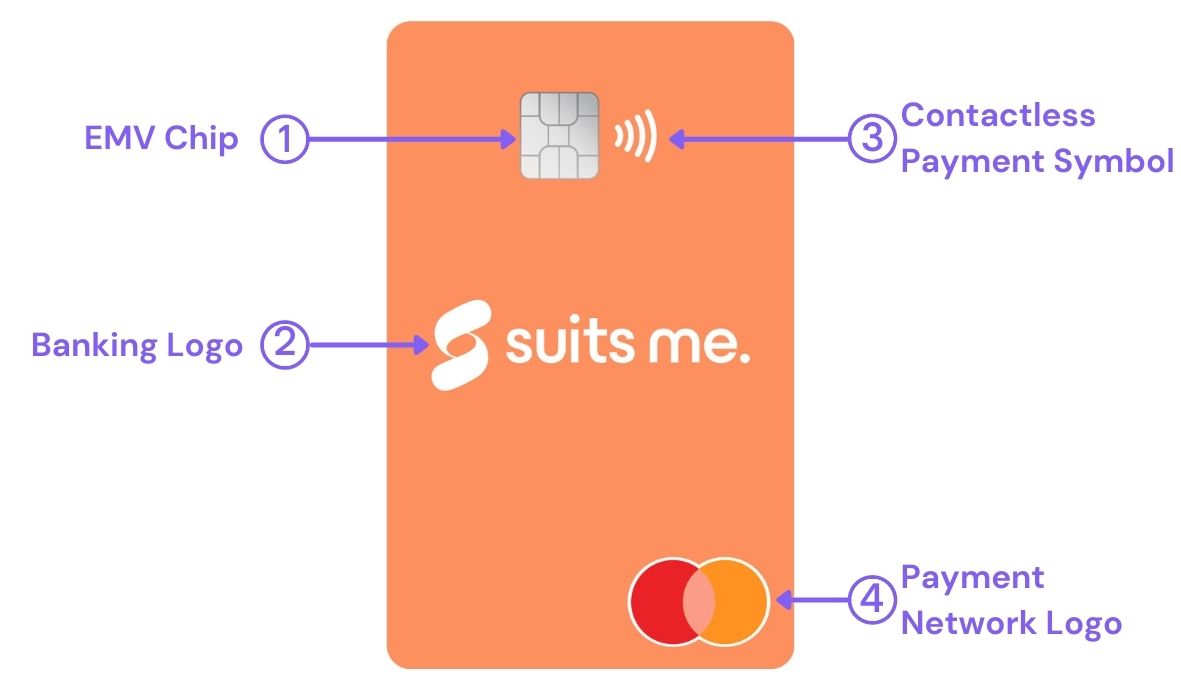

Front of the Debit Card

1. EMV Chip

EMV stands for Europay, Mastercard and Visa, as these are the three companies that began the chip initiative.

The chip safely stores your account information and helps to provide better protection against fraud by initialising the chip and pin payment method.

2. Logo

That’s us.

The issuin building society, alternative baking solution or prepaid card company will generally place their logo somewhere on the front of their debit cards.

3. Contactless Payment Symbol

The ‘Contactless’ payment symbol means that the card is contactless-enabled.

All Suits Me® debit cards are contactless-enabled, meaning you don’t need to use you Chip and PIN for purchases up to £100. Contactless payments can be anywhere you see the contactless payment logo. To use the contactless payments feature on your card, simply hold your card over the card payment reader.

4. Payment Network Logo

The ‘Payment Network’ logo tells you what type of card you have, with the most common being Visa and Mastercard. You can use your debit card to make a payment anywhere where you can see this logo.

Suits Me® cards are Mastercard® Debit cards and can be used in over 24 million places worldwide.

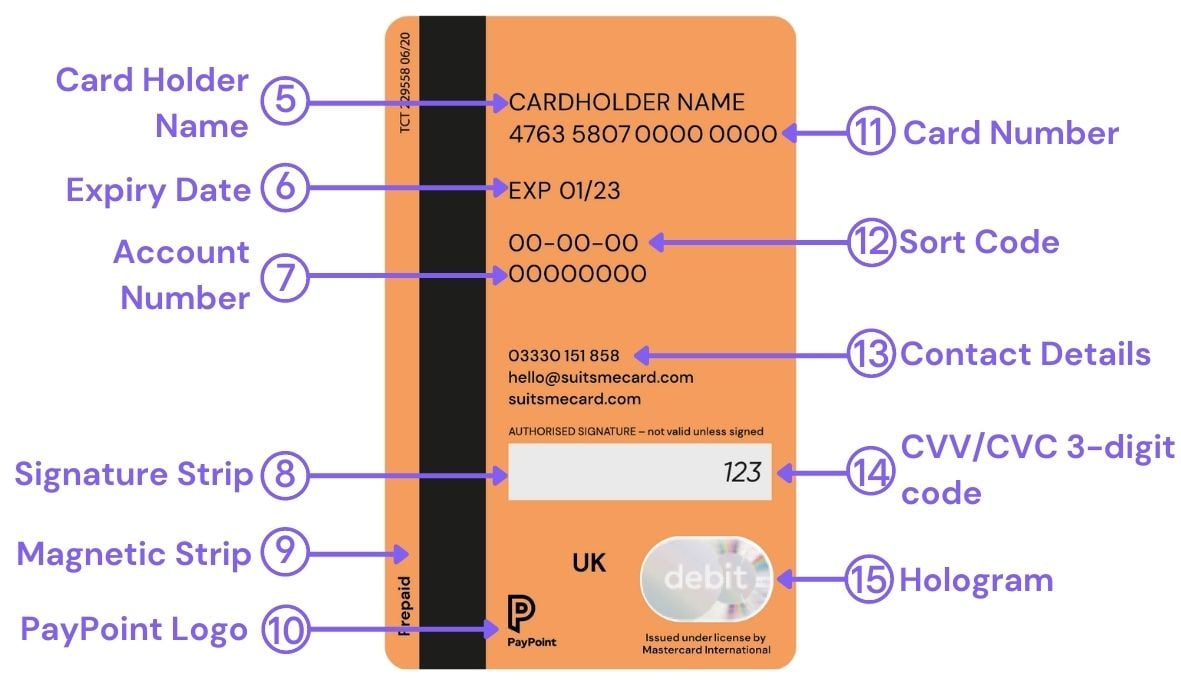

Back of the Debit Card

5. Card Holder Name

This is the name of the person that the debit card belongs to.

This isn’t always the name of the account holder. For example, if you have Suits Me® account, you can also authorise someone to have a debit card in their own name that’s linked to your account.

6. Expiry Date

The ‘Expiry Date’, often labelled as ‘Expires End’ is the date at when your card expires.

When your Suits Me® card is due to expire, you will receive a new one free of charge before the expiry date. If the card is due to expire at the end of a month, your new card will be issued at the beginning of that month. If the card is due to expire at the beginning of the month, a new card will be issued to you the month before the expiry date.

7. Account Number

An ‘Account Number’ is an eight-digit number that is linked to your account.

An account number is required when transferring money into an account, including your wages. To have your wages paid into your account, you’ll need to provide your employer with your account number and sort code.

8. Signature Strip

The signature strip is for you to add your signature to prior to using the debit card.

This is a security feature as some payments may require you to sign upon making a payment. In this case, the merchant will compare the signature on the strip to the signature you use upon payment to verify that they match. The majority of merchants won’t accept a debit card as a payment method that hasn’t been signed.

9. Magnetic Strip

The black colour strip contains secure information about you, your account and card. Only card readers can gather and read the information safely stored within the magnetic strips.

10. PayPoint Logo

Add cash to your Suits Me® Account quickly and easily using PayPoint. Visit your nearest PayPoint store with your Suits Me® debit card and the cash that you wish to load onto your account. Using this service will add the cash into your account instantly.

Paypoint has over 28,000 locations across the UK, and you can usually find them within high street convenience stores and off-licenses.

Find Your Nearest PayPoint Location here.

11. Card Number

One of the most important parts of a debit card and often referred to as ‘the long card number’ (and also known as a Permanent Account Number or PAN), the card number consists of 16 digits in sections of four, for example, 1234 5678 9876 5432 and is required when making a purchase over the phone or online.

Safety Tip: Keep your card number safe and private, don’t type it into an email or take a picture of it.

12. Sort Code

A ‘Sort Code’ is a six-digit number that identifies your payment provider, building society or alternative solution. The number is usually split up into pairs, for example; 12-34-56 and is linked to your account.

At Suits Me®, we have two sort-codes: 62-30-53 and 60-83-70 – If you’re a Suits Me® customer, your sort code will be one of these.

A sort code is required when transferring money into an account, including your wages. To have your wages paid into your account, you’ll need to provide your employer with your sort code and account number.

13. Contact Details

On Suits Me® debit cards, these are our contact details so you always have them to hand when needed. However, we do recommend you store our contact numbers safely in your phone in case your card becomes lost or stolen. Our contact details can be found in many other easy to access places including the Contact Us page on our website, within the mobile app and your online money account.

14. CVV/CVC 3-Digit Code

Also known as the ‘security code’, ‘CV2’ or ‘last three digits on the back of the card’, this code is unique to you and your debit card. These three digits ensure that your card is legitimate and is required when making a payment online or over the phone.

15. Hologram

A hologram on a card is a small, silver-coloured mirror-like section with a 3D image. This is another security feature of debit cards and allows merchants to spot the difference between a real card and a fake card.

Useful Information

Open Your Account Today

Get your debit card in 3-5 working days – NO credit checks!