Have an IVA and need an account?

If you’re entering into or are in an IVA (Individual Voluntary Arrangement), we provide instant personal accounts in minutes.

✅ No minimum deposits

✅ Premium rewards as standard

If you’re entering into or are in an IVA (Individual Voluntary Arrangement), we provide instant personal accounts in minutes.

✅ No minimum deposits

✅ Premium rewards as standard

Why open an account with Suits Me when you have an IVA?

There are many reasons why a Suits Me personal account is a great option if you have an IVA.

Safe & secure

Suits Me are different to a bank. We are regulated by different rules. Customer funds are safeguarded at all times and held in a separate client account.

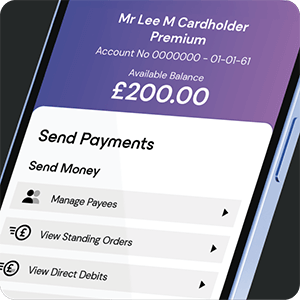

Send & receive payments

Receive and send money in the UK and abroad easily. Our Faster Payments are seriously fast and can all be done self serve via our app.

Exclusive discounts with top brands

Access our exclusive customer discounts with top brands when you have an account with Suits Me. New partners are added every week, with money-off deals at Just Eat, Lebara, Lotto Social, Fiit and many more.

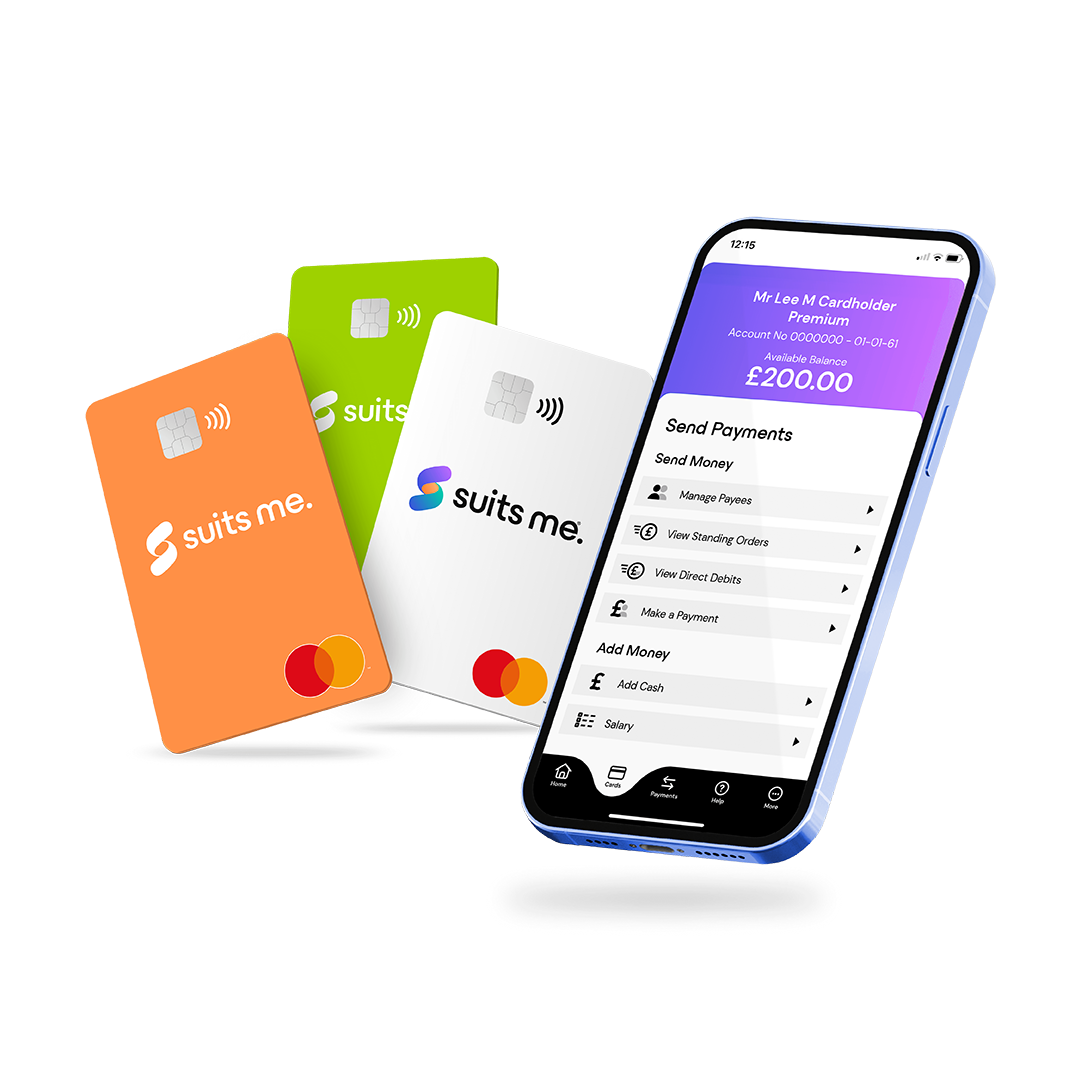

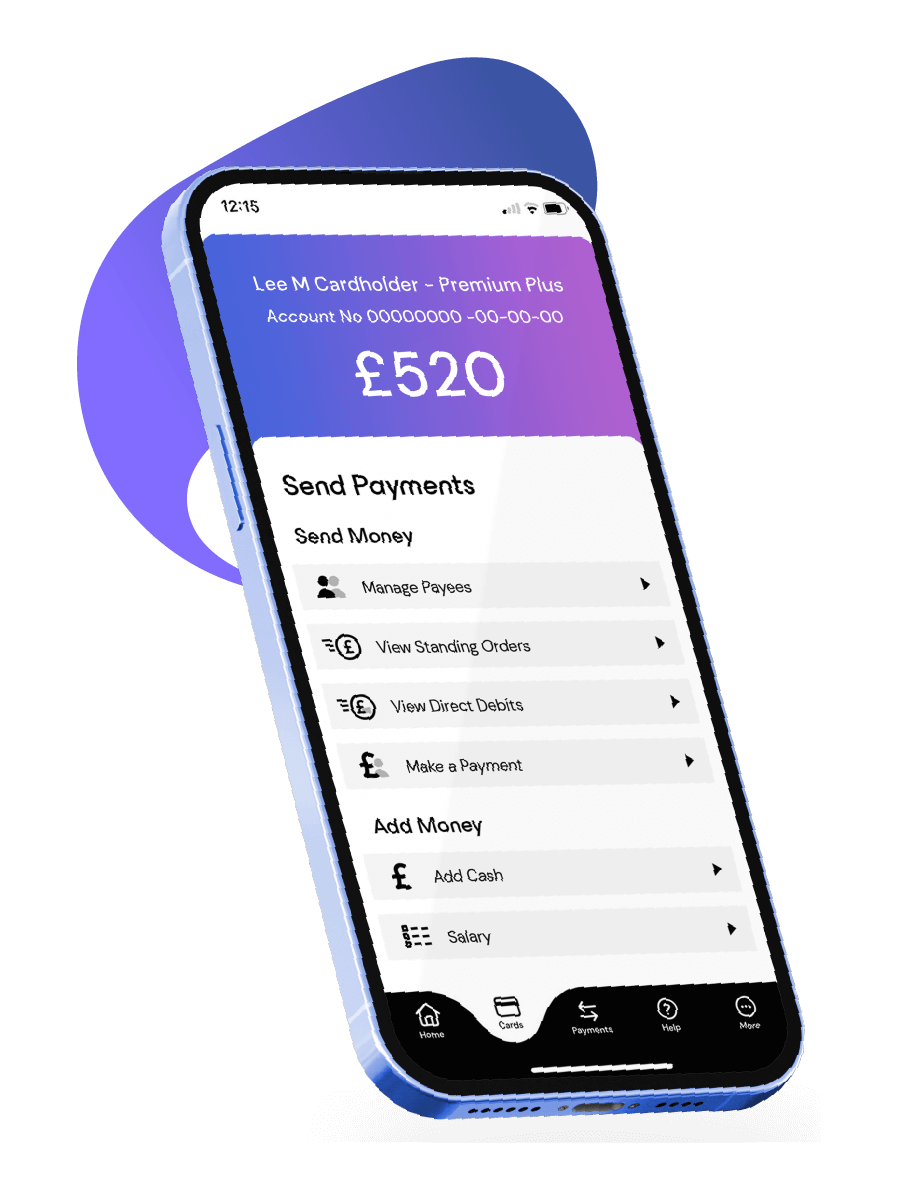

Easy to use mobile app

Our Mobile App allows you to manage your finances on the go. Instant notifications on spending and deposits to your account.

Nemzetközi átutalások

Kedvenc partnerünk, a Remitly segítségével könnyedén küldhetsz nemzetközi fizetéseket és fogadhatsz nemzetközi átutalásokat a Suits Me számládra.

Wages & benefits

Provide your sort code and account number to your employer or benefits provider to have funds transferred directly into your Suits Me account.

Join the thousands of people changing their lives

Nesha’s story

Eddie’s story

Peter’s story

Awards

British Bank díjak

Legjobb folyószámla-szolgáltató 2022 döntőse

SME News

A leginnovatívabb banki szolgáltatás 2023.

British Bank díjak

A legjobb újonc 2020. Nagy dicséret

Hogyan nyithatja meg fiókját

1. Nyomja meg a gombot

2. Töltse ki az űrlapot

3. Töltse le az alkalmazást

Your account will be opened and your sort code and account number will be sent immediately.

A free contactless Debit Card will be sent via first class post.

Do I need to declare my financial situation?

When you open your Suits Me account, we will not ask for your financial history (such as your credit score, information about bankruptcy, and whether you’re in an IVA).

All we need from you is a form of ID and your contact details – it’s as simple as that. We also have a high acceptance rate for applicants who apply for an account with us.

If you’ve simply had difficulty getting accepted elsewhere, our bad credit account options may also be helpful.

Everything you need to know about using an account with an IVA

When you’re in the IVA process, you’ll be aware that you need to close your personal account, which can be incredibly frustrating.

This is due to the fact that traditional banks can be reluctant to offer an account to people going through an IVA – the same way they’re unlikely to offer services to people with particularly bad credit history or those who are bankrupt.

This is one of the many contributions to financial exclusion around the UK, where people cannot access even basic options. Below are some frequently asked questions about how an IVA can affect your personal finance.

Don’t let an IVA stop you from successfully managing your money

We make it hassle free when you open your Suits Me account.

We don’t require verified proof of UK address and we don’t carry out a credit check. If you apply today your account will be open in under 3 minutes.

As soon as your account is open, you’ll gain instant access to your sort-code and account number, an array of banking like features and online money account and mobile app to be able to start managing your money and finances. Your Suits Me Mastercard® debit card will then arrive in the post 3-5 days later.

So, what are you waiting for? Open your account today to support you in your debt-free journey.

Choose the right account for you

Essential

Back Up Account

Pay as you go /month

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

Premium

Spending Account

£5.97 /month

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

Premium Plus

Main Account

£9.97 /month

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

FAQs

What is an IVA?

An IVA is an Individual Voluntary Arrangement. It is a formal agreement for you to pay back your creditors.

How much does an IVA leave you to live on?

This depends on your household income and expenditure. Your IVA payment will be the amount of money left over, once all of your essential living costs have been deducted from your income. For example, if you earn £2,000 and your total living costs are £1,850 then your IVA payment will be £150.

How serious is an IVA?

An IVA can negatively impact your credit score, however it can also help you improve your finances in the long term.

Which is worse – a CCJ or IVA?

Both appear on your credit file and negatively impact your credit rating, but a CCJ is not something you can control. Only a creditor can apply for the judgement, but you can set up an IVA yourself.

Can I open a bank account while in an IVA?

Yes. Many people in an Individual Voluntary Arrangement (IVA) can still open a bank account. Some high-street banks may limit certain services, but there are account providers that allow you to manage everyday banking without requiring a credit check.