Even though most people think that slavery only exists overseas, modern slavery in the UK is thriving. According to the Centre for Social Justice (CSJ) and Justice and Care, there are upwards of 100,000 people trapped in modern slavery in the UK today.

Most commonly people are trafficked into forced labour in industries such as agriculture, construction, hospitality, manufacturing and car washes. Most people are trafficked into the UK from overseas, but there is also a significant number of British nationals in slavery. The most common countries of origin are Albania, Vietnam, Nigeria, Romania and Poland.

What is the Modern Slavery Act Legislation?

In 2009 the UK Government introduced the National Referral Mechanism. To further focus on this issue, a number of current laws were brought together when in 2015 the Government introduced the Modern Slavery Act Legislation.

Amongst other things, this requires – and indeed places an emphasis on – companies with an annual turnover of over £36 million to issue annually, a Modern Slavery Statement. It reads: “The Transparency in Supply Chains provision in the Modern Slavery Act seeks to address the role of businesses in preventing modern slavery from occurring in their supply chains and organisations.”

This is to ensure that those companies with a lower turnover are encompassed, those within the scope of issuing a statement are responsible for ensuring that their supply chain has in place checks and balances.

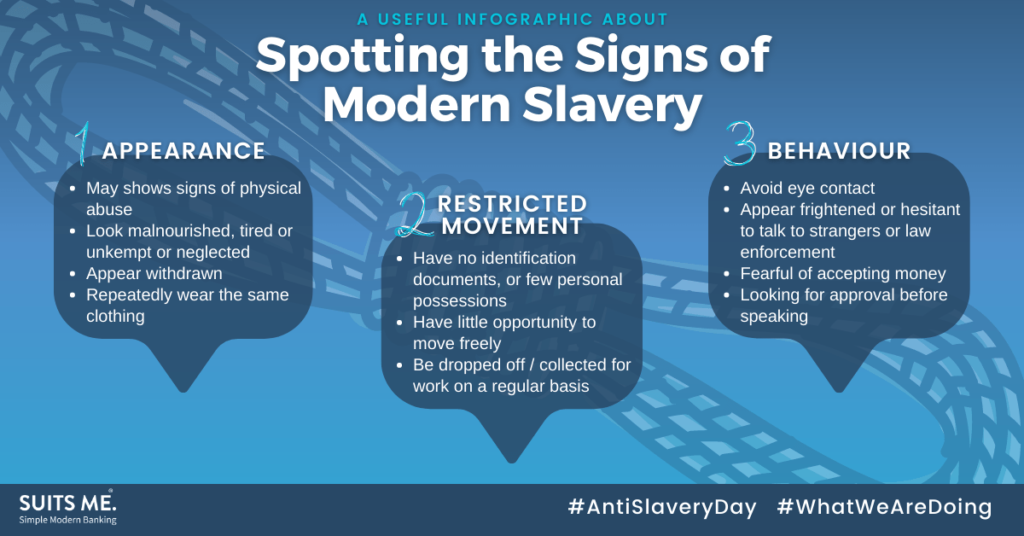

The Government and several other bodies (including the Gangmaster’s & Labour Abuse Authority (GLAA)) have published papers, ran a TV advertising campaign, arranged seminars, and issued guidance notes to assist employers (and their Employees) in identifying the signs of Modern Slavery, whether that be an individual case or as a group of people.

👉 For more information, check out our informative blog post on How Banks can be at the Forefront of Tackling Modern Slavery?.

What Have Companies Done to Help Prevent Modern Slavery?

Across the whole spectrum of UK PLC, Companies have been writing statements, posting them on their websites and in company reports. One of the important notes to make is the term ‘Annual’. Companies must demonstrate annually an effective policy is in place and steps and reviews are taken.

Is this just a paper exercise and companies are simply ‘toeing the line’ or are they taking a proactive approach in adopting this and applying it within their CSR programmes?

💡 Here at Suits Me®, we’ve put together a Modern Slavery Resource Hub to help raise awareness and share useful guides, tips and resources to help stamp out this horrific crime.

What has Modern Slavery got to do with Banking?

- Firstly, and in simple terms, people can be paid via cash, cheque, or a Bank Transfer (to an account not in their name). From the evidence gathered over the years by Enforcement Agencies, all three methods can indicate forced labour and/or coercion, i.e. does the individual have full control of their money?

- Secondly, legal migrants coming to the UK and even UK citizens returning from overseas, generally will not satisfy the UK Banking Industry compliance checks for a basic bank account and these underbanked groups are left with no choice but to take one of the options outlined earlier.

There are alternatives provisions coming from the fintech industry for this group, thus ensuring that every person has financial control of their income.

In speaking to businesses across the full spectrum of size and industry, some are taking this seriously, others see this as the individual’s problem and despairingly, a number are oblivious to the Act and their legal and moral responsibility.

Identifying the Signs of Modern Slavery

As an employer, it’s important to ensure your workers are cared for and are not being exploited. Here are a few questions to ask yourself to ensure you’re compliant with modern slavery.

- Are many employees living at the same address?

- People paid in cash – quite simply don’t!

- If you issue cheques – is this in the person’s name? If not, don’t!

- If cheques are issued correctly, is this fair on your employee? The cost of cashing a cheque varies from a local arrangement with a bank to a face value cost of between 5% to 18% via cheque exchanges.

- By transfer – Does the name of the account payee match that of the employee? If not, investigate

- By transfer into an account of the employee’s name – hopefully, that’s everyone!

Although a tick in a box may seem that you’re compliant in modern slavery prevention, tackling modern slavery in the workplace and indeed in wider society is not about just simply ticking boxes. One could easily argue that as a human citizen, it’s an obligation.

Alternative Banking with Suits Me®

Suits Me® was launched in February 2015, and to date has created over 125,000 e-money accounts for migrant and temporary workers. In 2016, we received two awards from within the industry (UK & European) for ‘bringing financial inclusion to a previously excluded group’.

Our aim is to be an ethical and accessible route for companies and most importantly, affordable for Individuals. The program has been created and developed to enable individuals to take control of their finance in a secure way.

At Suits Me® we’ve often noticed the links between financial exclusion – whereby people find themselves locked outside of the mainstream banking system – and the increased risk of modern slavery and exploitation. We believe that by ensuring everyone has access to secure, modern banking we can help combat modern slavery.

We offer your workers a contactless Mastercard® debit card and access to online banking and a personal mobile banking app, so they can manage their finances on the go, 24/7. We also offer an exclusive cashback reward programme so your workers can automatically receive money back when they use their Suits Me® card with our retail partners.