CIFAS marker bank account

Are you tired of being declined bank accounts due to a CIFAS marker?

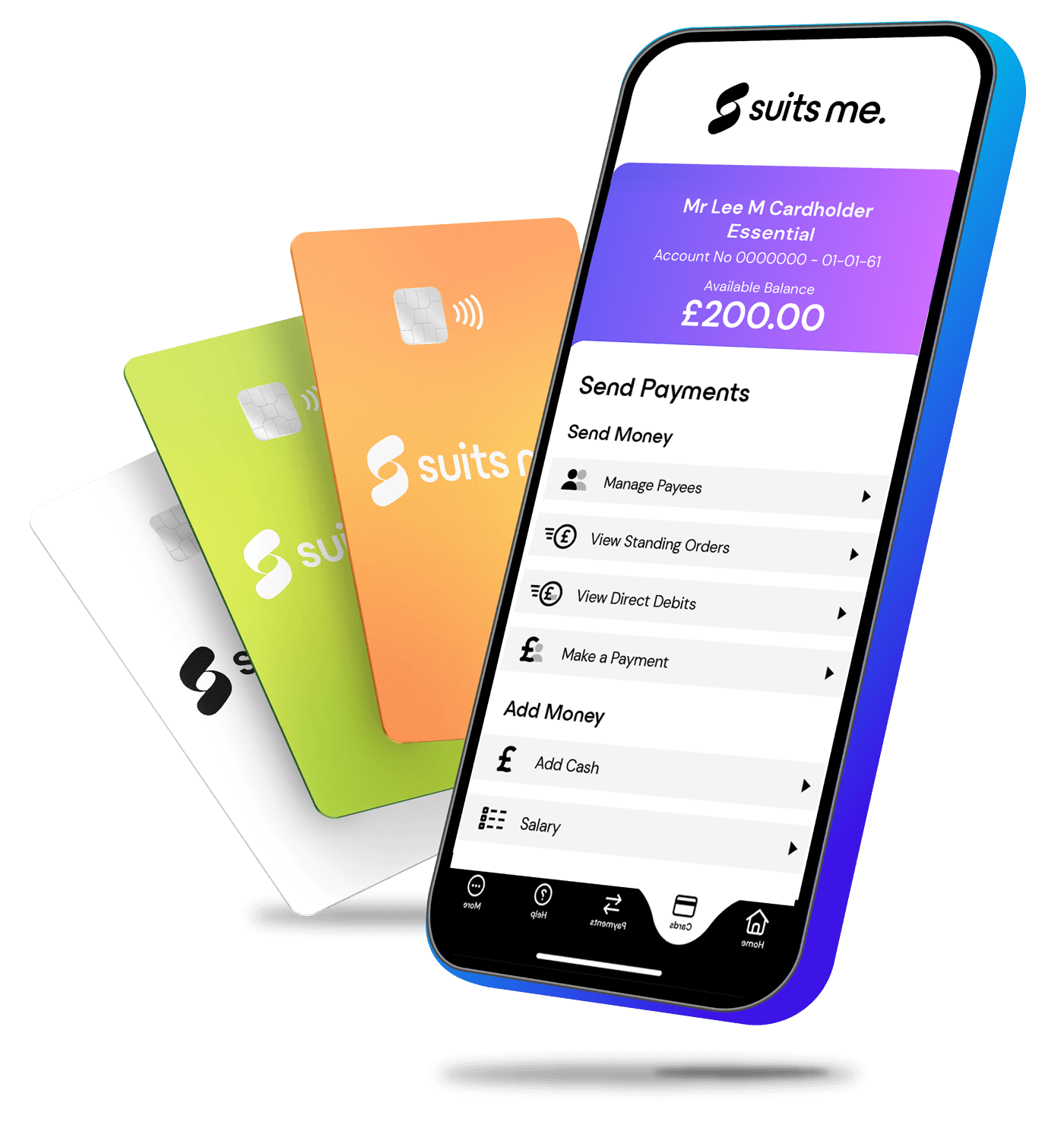

Suits Me® have helped lots of people with CIFAS markers with a secure account solution.

With Suits Me, your CIFAS marker won’t automatically stop you from opening a UK account.

✔ We don’t use CIFAS data

✔ We don’t access the CIFAS database

✔ Your marker does not lead to automatic rejection

✔ Apply quickly and securely online

✔ Get a UK account number & sort code once verified

What is a CIFAS marker?

CIFAS is the UK’s fraud prevention service. CIFAS stands for Credit Industry Fraud Avoidance System. CIFAS markers pose as warnings about the risk you represent to a bank or business. CIFAS put markers against your credit report if an organisation, such as a bank or loan company, suspects you of fraudulent activity.

A CIFAS marker can be placed on your file when:

- You’ve been a victim of identity theft

- Your details have been used fraudulently

- A bank suspects misuse of an account

- There’s a dispute or misunderstanding around financial activity

Most people with CIFAS markers are victims, not fraudsters.

Unfortunately, high-street banks often treat all markers the same — which leads to automatic declines.

How Suits Me can help if you have a CIFAS marker?

Suits Me are not member of CIFAS, which is a not-for-profit organisation. We do not report into CIFAS, nor use their data.

At Suits Me, we use advanced technology to prevent fraud. We have a zero tolerance towards fraudulent acts, however we also have an inclusive approach to those who have been victims of fraud and found themselves with a CIFAS marker because of it.

As we do not conduct credit checks at Suits Me, your CIFAS marker will not stop you in opening an account to manage your money.

It’s easy

to open your account

How a CIFAS marker affects your banking

When you apply for a bank account, most high street banks carry out a credit check. If a CIFAS marker shows up, your application will likely be refused automatically, even if your finances are otherwise in good shape. We know how frustrating that can be.

A marker can also affect:

- Mortgages – most lenders will decline applications while a marker is active.

- Loans & credit cards – often unavailable until the marker expires.

- Overdrafts – usually refused.

The impact depends on the type of marker you have. For example, a Protective Registration may still allow you to open certain accounts, but you’ll have to go through extra verification steps.

Why choose Suits Me?

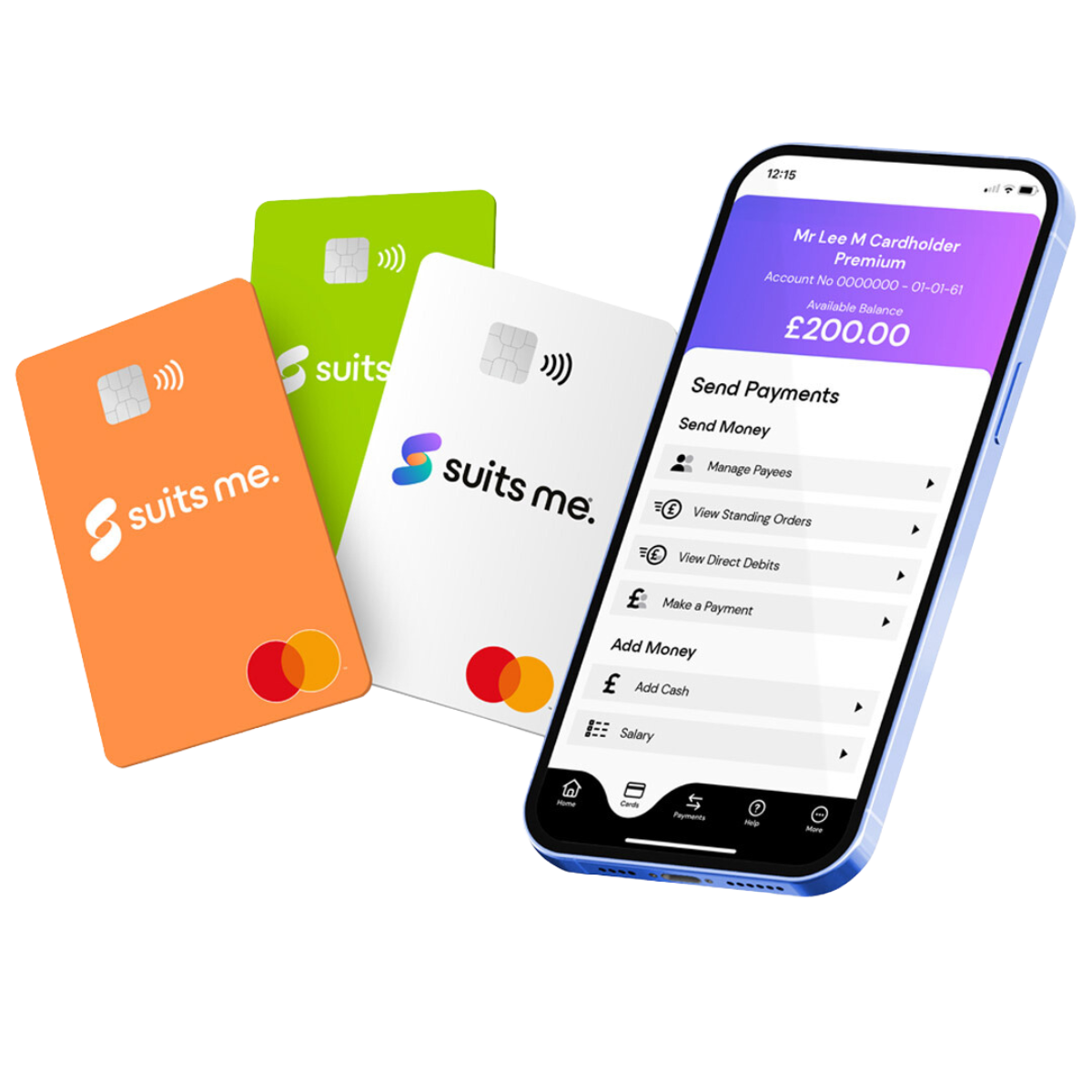

Quick set up and start using your account without delay

No long forms, no branch visits, no complicated steps. Suits Me® keeps the process fast and stress-free.

Do everything you need from one account

Receive payments, organise bills, make transfers, shop online, withdraw cash and keep track of spending, all in one place.

Stay on top of your money with real-time insights

Instant notifications, clear transaction lists, and easy-to-use budgeting tools help you stay in control and avoid surprises.

Use your card anywhere Mastercard® is accepted

Your contactless debit card gives you flexibility at home and abroad, whether you’re buying groceries, booking travel or just tapping to pay on the go.

Make life easier with automatic payments

Set up Direct Debits and standing orders to handle bills, subscriptions and regular transfers with complete confidence.

Earn cashback on everyday shopping

Make the most of your spending with cashback at a growing range of retailers. Simple, automatic and built into your account.

Customer support that cares

Our multilingual customer support team is here to help when you need it, offering guidance and clarity every step of the way.

Security you can trust

Your money is safeguarded under strict regulatory requirements, giving you peace of mind every time you use your account.

Can you open a bank account with a CIFAS marker?

Yes – but your options are limited. The steps to take are:

- Check your marker – request your CIFAS record and understand its type and expiry date.

- Gather ID documents – you’ll still need proof of ID and address.

- Apply to a provider that doesn’t run credit checks – such as Suits Me.

With Suits Me you can open an account in minutes — even with a CIFAS marker.

Living with a CIFAS marker

CIFAS markers can affect you in lots of ways including:

Banking: A bank may close or block your access to your account, freezing your funds and transactions to certain services.

Access to credit: CIFAS markers can stop you accessing credit, such as an overdraft or loan. Lenders can view you as a high-risk customer and decline your application for credit.

Insurance: Some Insurance companies may check your credit history before issuing policies. As a CIFAS marker represents a higher risk, this can increase your premiums or cause you to be rejected for insurance.

Employment: Job applications in the financial sector will be difficult. Financial institutions often require a credit check before offering employment, along with other specific types of employers. A CIFAS marker can limit your opportunities of employment through either being rejected on application or termination of employment.

Reputation: A CIFAS marker can damage your reputation.

Legal proceedings: CIFAS markers can be used as evidence in legal proceedings in some circumstances.

We have an account that will suit you

Essential

A Back Up Account

Pay as you go

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

Premium

Spending Account

£4.97 /month

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

Premium Plus

Main Account

£9.97 /month

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

FAQs

How to remove a CIFAS marker?

Firstly, obtain a copy of the CIFAS report by making a direct subject access request directly to CIFAS. You can then clearly see what has been alleged and by whom. If you disagree with the marker, challenge your bank directly. If they disagree in their final response, you can then contact CIFAS directly. Lastly, if CIFAS refuse to remove your marketer you can contact the Financial Ombudsman.

How long do CIFAS markers last?

CIFAS markers can be held for up to six years in the CIFAS database.

Do banks accept CIFAS markers?

Most banks do not accept individuals with CIFAS markers. To open a bank account with a mainstream bank they will conduct credit checks which will immediately notify them of your CIFAS marker. Suits Me do not undertake credit checks, we do accept applications from people with CIFAS markers, those who have been victims of fraud have opened an account in minutes when their account has been blocked and a CIFAS marker has been placed against them.