Banking account for bankruptcy

Suits Me® provides an accessible account option that’s available even if you’re bankrupt or an undischarged bankrupt.

✅ No impact from your bankruptcy status

✅ A stable account for salary, benefits & pension

✅ Easy online application

✅ UK account details once verified

✅ Free contactless debit card for everyday use

Suits Me® provides an accessible account option that’s available even if you’re bankrupt or an undischarged bankrupt.

✅ No impact from your bankruptcy status

✅ A stable account for salary, benefits & pension

✅ Easy online application

✅ UK account details once verified

✅ Free contactless debit card for everyday use

Going through bankruptcy can limit your options.

Many high-street banks automatically block or downgrade accounts during bankruptcy — leaving their customers without a safe, simple way to receive income and manage everyday payments.

When someone is declared bankrupt, UK banks often:

- Freeze or close existing accounts

- Restrict features such as Direct Debits and debit card use

- Decline new applications

- Carry out enhanced risk checks

- Remove access to overdrafts

- Require additional proof of identity or financial information

Going through bankruptcy? You need a reliable way to manage your money.

Having a bankrupt status can leave you without a basic way to manage your money when you need it most.

That’s where Suits Me® can help, so that you can still:

- Get paid by your employer

- Pay rent or bills

- Access cash

- Manage essential spending

- Receive benefits or pension payments

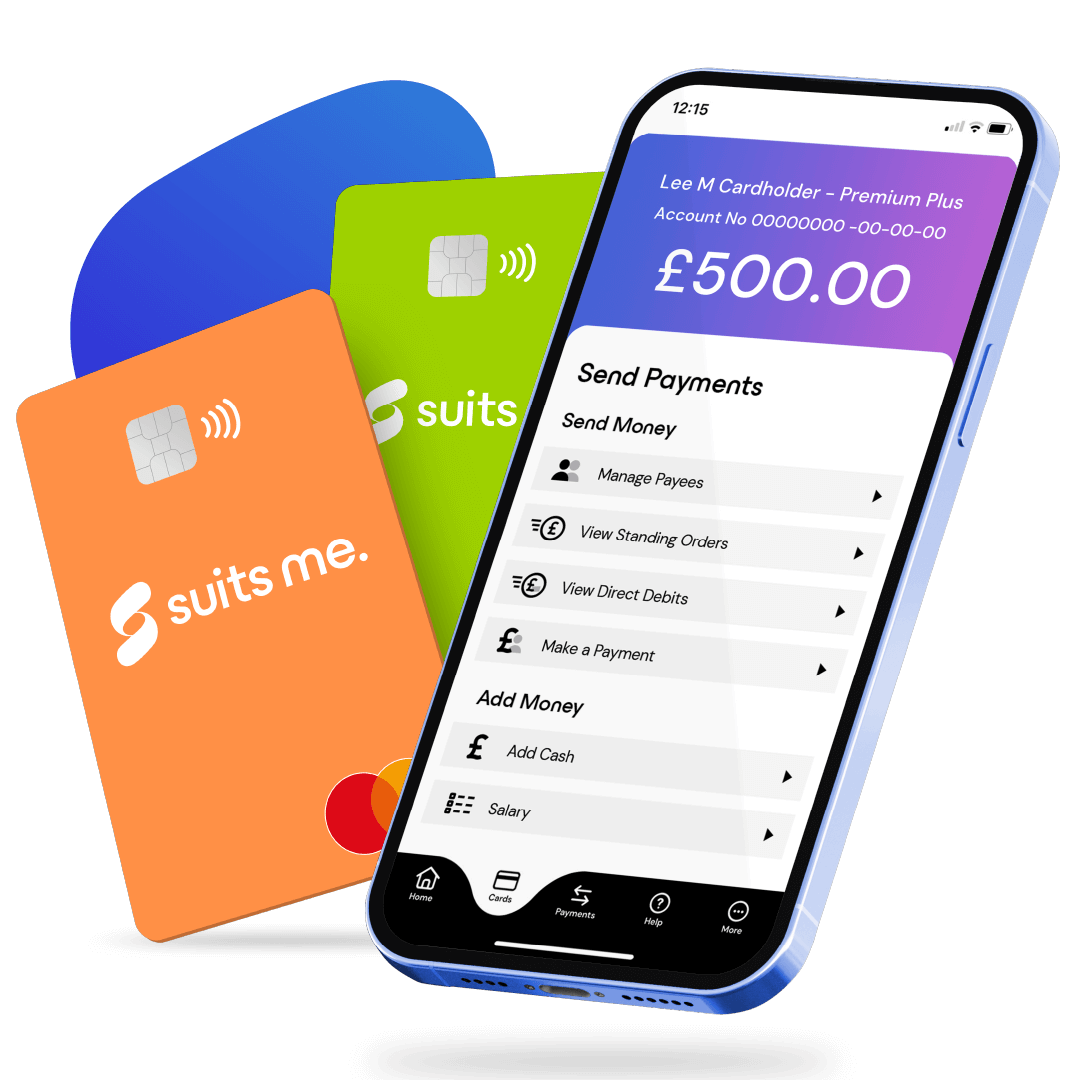

A practical account during bankruptcy

Whether your bank has closed your account or you want a stable alternative while going through the bankruptcy process, Suits Me® provides a reliable way to stay financially organised.

Keep receiving income

Use your UK account details to get paid without interruption

Pay bills & manage essential payments

Set up Direct Debits and standing orders to keep bills on track

Use your contactless debit card

Tap to pay in shops, withdraw cash and shop online

Track your spending

Use the mobile app to stay in control and avoid surprises

No dependency on credit history

Bankruptcy doesn’t prevent you from applying for a Suits Me® account

Suits Me® helps – before, during & after bankruptcy

Before bankruptcy

If your account is at risk of being frozen or reviewed, Suits Me® provides a stable alternative to ensure your essential payments continue.

During bankruptcy (undischarged)

Many high-street banks impose restrictions or close accounts entirely during bankruptcy. Suits Me® offers a safe option so you can continue managing your money.

After discharge

Use your Suits Me® account as a long-term way to receive income, organise bills and rebuild financial confidence.

We have an account that will suit you

Essential

A Back Up Account

Pay As You Go

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you. For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

Premium

Spending Account

£4.97 /month

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice. Cashback, discounts, and everything you need to spend with ease.

Premium Plus

Main Account

£9.97 /month

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice. Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

Banking during bankruptcy

Suits Me vs. High Street Banks

Feature / Requirement |

|

|

| Accepts bankrupt applicants | Yes | Limited or none |

| Uses credit history | Not used | Yes |

| Account closures in bankruptcy | Not automatically | Common |

| Overdrafts | Not available | Not available |

| Apply online | Fully online | Limited |

| Suitable during bankruptcy | Yes | Often no |

Open your Suits Me account in minutes

- Start your online application

- Upload your proof of identity

- Complete the verification steps

- Receive your account details once verified

- Get your debit card within a few days

You can begin using your account right away to receive income, pay bills and manage essential spending.

Stay financially stable throughout your bankruptcy

Bankruptcy is challenging, but losing basic banking access shouldn’t be part of the struggle.

Suits Me® gives you a dependable way to receive money, pay bills and stay on track.

FAQs about Bankruptcy and Suits Me

Can I open an account if I’m an undischarged bankrupt?

Yes you can. Your bankruptcy status does not automatically prevent you from applying.

My bank closed my account because of bankruptcy. Can I use Suits Me® instead?

Will bankruptcy affect my application?

No. We do not use your credit history to decide your eligibility.

Can I receive my salary, benefits or pension into this account?

Yes — simply give your employer or provider your UK account details once verified.

Can I rebuild my finances using this account?

Your Suits Me® account gives you stability and control, helping you manage essential payments after your bankruptcy is discharged.