No proof of address?

Need a bank account?

Suits Me offer something different.

An alternative to a bank account with all the features you need to manage your money.

✅ No verified proof of address*

✅ No credit checks

✅ Account opening in minutes

✅ No minimum deposits

✅ Rewards as standard

*Subject to AML regulatory requirements.

Suits Me offer something different.

An alternative to a bank account with all the features you need to manage your money.

✅ No verified proof of address*

✅ No credit checks

✅ Account opening in minutes

✅ No minimum deposits

✅ Rewards as standard

*Subject to AML regulatory requirements.

Open your account todayWhy choose Suits Me?

At Suits Me, we know that for some people, providing proof of address can be hard or even impossible.

Many people in the UK live in a house share or with your family, where their name isn’t on any of the bills, or perhaps they are new to the country so still getting settled.

We believe no one should be excluded and left without an account to manage their money safely and securely. You can open a Suits Me account online, with no credit checks or verified proof of address, in minutes.

We are trusted by thousands of people across the UK.

We provide an account that works for you.

We don’t ask for 3 months verified proof of address*, we don’t conduct credit checks and we don’t ask for minimum deposits to unlock rewards. There’s no overdrafts, so you can better manage your money.

Our customer service is award-winning. We don’t use chatbots, we speak your language and we use real people who understand your needs.

If your circumstances change, we won’t charge to close your account.

*Subject to AML regulatory requirements.

Join the thousands of people changing their lives

Nesha’s story

Eddie’s story

Peter’s story

Awards

British Bank Awards

Best Current Account Provider 2022 Finalist

SME News

Most Innovative Banking Service 2023

British Bank Awards

Best Newcomer 2020 Highly Commended

Applying for an account without proof of address

To open a Suits Me account and receive your free debit card, all you need is photo ID and a selfie. We accept the following photo ID:

✅ Passport

✅ Driving Licence

✅ Provisional Driving Licence

✅ National ID Card

✅ ARC Card

✅ British Citizen ID Card

✅ British Residence Permit

What’s included with our accounts?

Open an account in minutes

Our advanced technology allows us to open accounts in minutes online, with the ID that YOU have.

Safe & secure

Suits Me are different to a bank. We are regulated by different rules. Customer funds are safeguarded at all times and held in a separate client account.

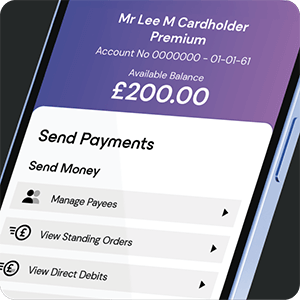

Send & receive payments

Receive and send money in the UK and abroad easily. Our Faster Payments are seriously fast and can all be done self serve via our app.

Exclusive discounts with top brands

Access our exclusive customer discounts with top brands when you have an account with Suits Me. New partners are added every week, with money-off deals at Just Eat, Lebara, Lotto Social, Fiit and many more.

No minimum balances

There are no minimum deposits or balances required to open a Suits Me account and enjoy all the benefits.

Standing orders & Direct debits

You can pay Direct Debits and set up Standing Orders from your account.

Easy to use mobile app

Our Mobile App allows you to manage your finances on the go. Instant notifications on spending and deposits to your account.

International transfers

With our preferred partner, Remitly, you can easily make international payments and receive international transfers into your Suits Me account.

Wages & benefits

Provide your sort code and account number to your employer or benefits provider to have funds transferred directly into your Suits Me account.

We have an account that will suit you

Essential

Best for occasional use

Pay as you go /month

-

Essential is our pay as you go card. An instant account to give you flexibility and control when you need a separate account. Our customers who need an account to use now and again rather than as a main account choose Essential. Although there is no set monthly fee, individual charges are higher than the other account types. Overall monthly costs can be higher than our other account types if used as a main account or high volumes of payments.

-

Essential is our pay as you go card. An instant account to give you flexibility and control when you need a separate account. Our customers who need an account to use now and again rather than as a main account choose Essential. Although there is no set monthly fee, individual charges are higher than the other account types. Overall monthly costs can be higher than our other account types if used as a main account or high volumes of payments.

Premium

Best for basic usage

£4.97 /month

-

Our Premium account is packed with extras. This account will let you do everything you need to manage your money whilst giving you cashback and discounts. Customers who need a basic and functional account for wages and benefits or have multiple payments into their account choose Premium.

-

Our Premium account is packed with extras. This account will let you do everything you need to manage your money whilst giving you cashback and discounts. Customers who need a basic and functional account for wages and benefits or have multiple payments into their account choose Premium.

Premium Plus

Best for main account

£9.97 /month

-

Our Premium Plus account is loaded with value plus you receive our VIP queue jump service. This account is a favourite with our customers with its inclusive package. The Premium Plus account is normally the cheapest option for those who want a fully functional bank account replacement as average usage is all included.

-

Our Premium Plus account is loaded with value plus you receive our VIP queue jump service. This account is a favourite with our customers with its inclusive package. The Premium Plus account is normally the cheapest option for those who want a fully functional bank account replacement as average usage is all included.

How to open your account

1. Hit the button

2. Fill out the form

3. Download the App

| Bad credit Bad credit can be a barrier to opening a bank account or accessing an account with rewards. Not with Suits Me. We support thousands of people who have bad credit and help them with an easy to use instant account. |

Bankrupt Dealing with debt is hard. If you have been made bankrupt, Suits Me can provide all the banking-like features you need. We make it easy to open an account and there is no risk of further debt. |

IVA If you are entering into or already in an IVA, it is best to open a new account. Suits Me provide fresh start accounts in minutes, getting you back on track with your finances. |

| No Credit Checks We do not conduct credit checks when you open an account with Suits Me. As we do not offer credit, we do not need to make a mark on your credit file. |

No Verified Proof of Address* Situations change and often our customers find that they don’t have the required documentation to prove their address. We don’t need you to provide 3 months proof of address to open a Suits Me account. |

No Photo ID* No passport or driving license? Not a problem. You can open a Suits Me account with a selfie and other alternative ID. As it is online, there is no need to post documents or visit a bank, and you can apply in minutes. |

| New to the UK Suits Me support those new to the UK by removing the challenges of opening a bank account. We accept the ID* you have on arrival and confirm your application online. With customer support in 19 languages, we can provide help in a language that suits you. |

CIFAS Markers CIFAS Markers can prevent you from opening a bank account. If you have been a victim of impersonation this can be very frustrating and unfair. We help those who are in this situation and need to open an account quickly online due to the closure of their previous account. |

Asylum Seekers We understand that arriving into the UK from overseas is difficult. Often, not having the required documents is a barrier to getting a bank account and starting your new life. With Suits Me, you can open an account online in minutes, with just a selfie and an ARC card *. |

| Students Our accounts are perfect for students who want to get cashback and access discounts. With no minimum deposits you can use our accounts to suit you needs. |

Gambling If you are looking to manage your gambling spending, Suits Me accounts can be set up in minutes and allow you to budget more effectively. Many Suits Me customers use our accounts to ensure gambling funds are kept separate from their main bank account. |

Gaming If you are looking for an account for online gaming, look no further. A separate Suits Me account can be set up in minutes and you can better manage your gaming spend. |

Apply online today for a

Suits Me debit card in just 3 minutes.

It’s this easy.

You will receive your FREE Mastercard® debit card within a couple of days, sent via first class post with Royal Mail.

Eligibility

If you are over 18 and live in the UK, you can apply for a Suits Me Account*.

*Subject to AML regulatory requirements.

Suits Me customer |

“I desperately needed a bank account but didn’t have proof of address. Suits Me helped me when no one else would. I can now make payments online and it is much easier to get my benefits.” |

Suits Me customer |

“Terrible credit and bankrupt couldn’t get an account anywhere! Accepted quickly and even though I made a mistake on application, Suits Me dealt with it in good time and I’m now an account holder again! Bad credit etc try Suits Me!!” |

Suits Me customer |

“I’m very happy to have found Suits Me while searching for a bank account that offers accounts to people like me with no credit history as I’ve just returned back to the UK after years and had no credit history, all other banks require some history and it’s very difficult for people newly moved into the country.” |

Dont just take our word for it!

Suits Me is a great alternative for those with no proof of address. All you will need is proof of ID and access to the internet to open a new account. It takes minutes to open.

Just look at the thousands of happy account holders on Trustpilot.