Once you have been accepted for your Suits Me account, you will receive your account number and sort code within 3 minutes.

Open your account

If you’re new to managing your finances you might not know what your account number and sort code are, where to find them and what they mean.

When any UK account is opened it’s given its own account number and sort code combination. Your provider uses them to identify your account and they let you make transfers of money from one account to the other.

This guide will walk you through what they are and when you should use them.

About account numbers and sort codes

Where do I find my account number and sort code?

You can find your account number and sort code when you log in to your online money account or your mobile app, but the easiest way is to just look at your card.

Log In to Online Money Account

Download our apps:

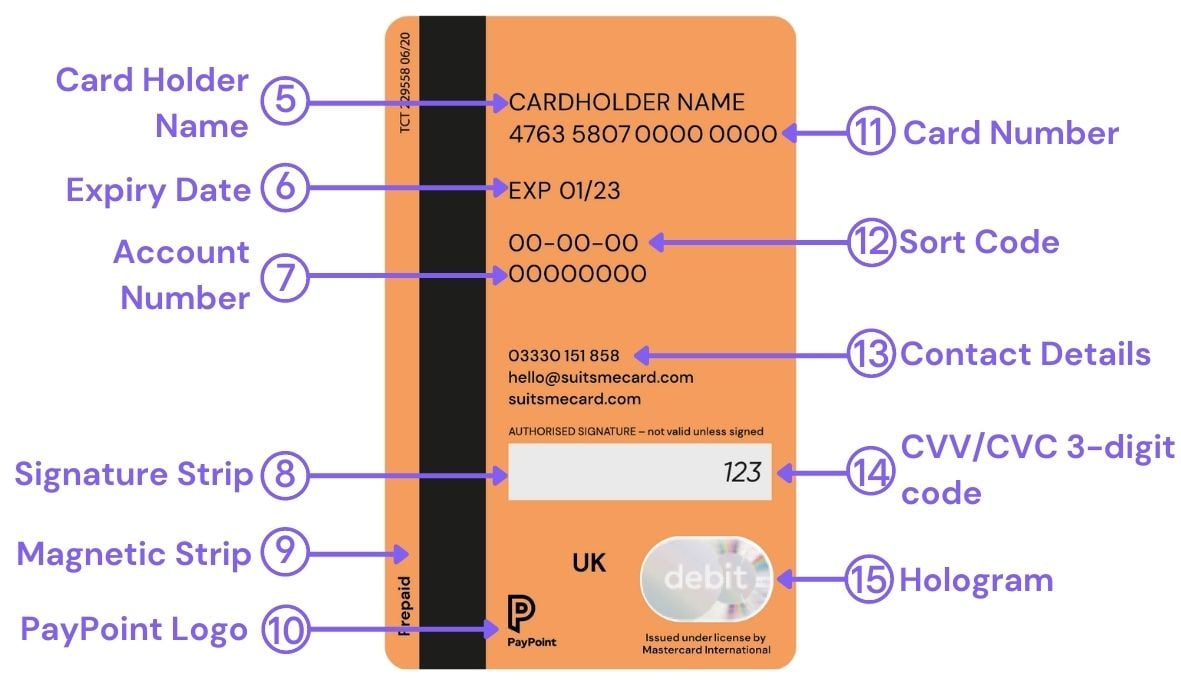

On the Suits Me debit card, the account number (7) and sort code (12) are both on the back of the card, below your name, the long card number and the expiry date.

For more information about your debit card, check the debit card features and functions page.

What is an account number?

An account number is personal to your account, meaning every personal, joint, business, etc. account has its own identifying number. This is usually 8 digits long.

So even if you have two or more accounts, even with the same provider, they’ll have different account numbers.

What is a sort code?

Your sort code is personal to the account your money is kept in, meaning if you have two accounts with the same provider, they might share a sort code.

In traditional banks, the sort-code is specific to the high street branch you bank with. For online accounts who don’t have branches, like Suits Me, they won’t have as many sort codes. We have got two sort codes depending on your account type.

When do I use an account number and sort code?

Typically, you should only give your account number and/or sort code out if you’re:

- Receiving transfers/payments from someone you know (e.g. friends, family and employers)

- Setting up a direct debit

- Speaking to a member of the Suits Me customer care team

Your account number and sort-code are used to locate your account. If someone is paying you, the sort code will let their provider know where your money account is and the account number will tell them which specific account it is.

If you want to send a transfer or payment to someone, you need to ask them for their account number and sort code.

How do I stay safe when giving out my account number and sort code?

Only give your account number and sort code to people you can trust including your friends, family, employers and Suits Me team members (only do this if you contact us directly, we will not ask for your account number unless you call our customer care team).

Your account number can help malicious hackers attempt to access your account, so only give it to someone you know.

- Where possible, do not give your account number and sort-code at the same time as other personal details such as your full name, address and phone number. This might not be possible depending on the transfer/direct debit.

- Do not give your long card number or the 3-digit CVV number at the same time as your account number and sort code. If someone asks for both the request might be fraudulent.

- Never give your PIN, password or one-time password (OTP) to anyone, including Suits Me staff members, regardless of where you’re sending your account number and sort code too.

Make sure you check your account regularly for unusual activity and always double-check the person/organisation requesting your account number and sort code is legitimate. Please report any suspicious activity to Suits Me® as soon as it happens.

Useful Information

Open your account today

Apply for an e-money account today and get your Mastercard® debit card in

3-5 working days – with no credit checks!