Bank accounts for bad credit

Struggling to get a bank account because of bad credit?

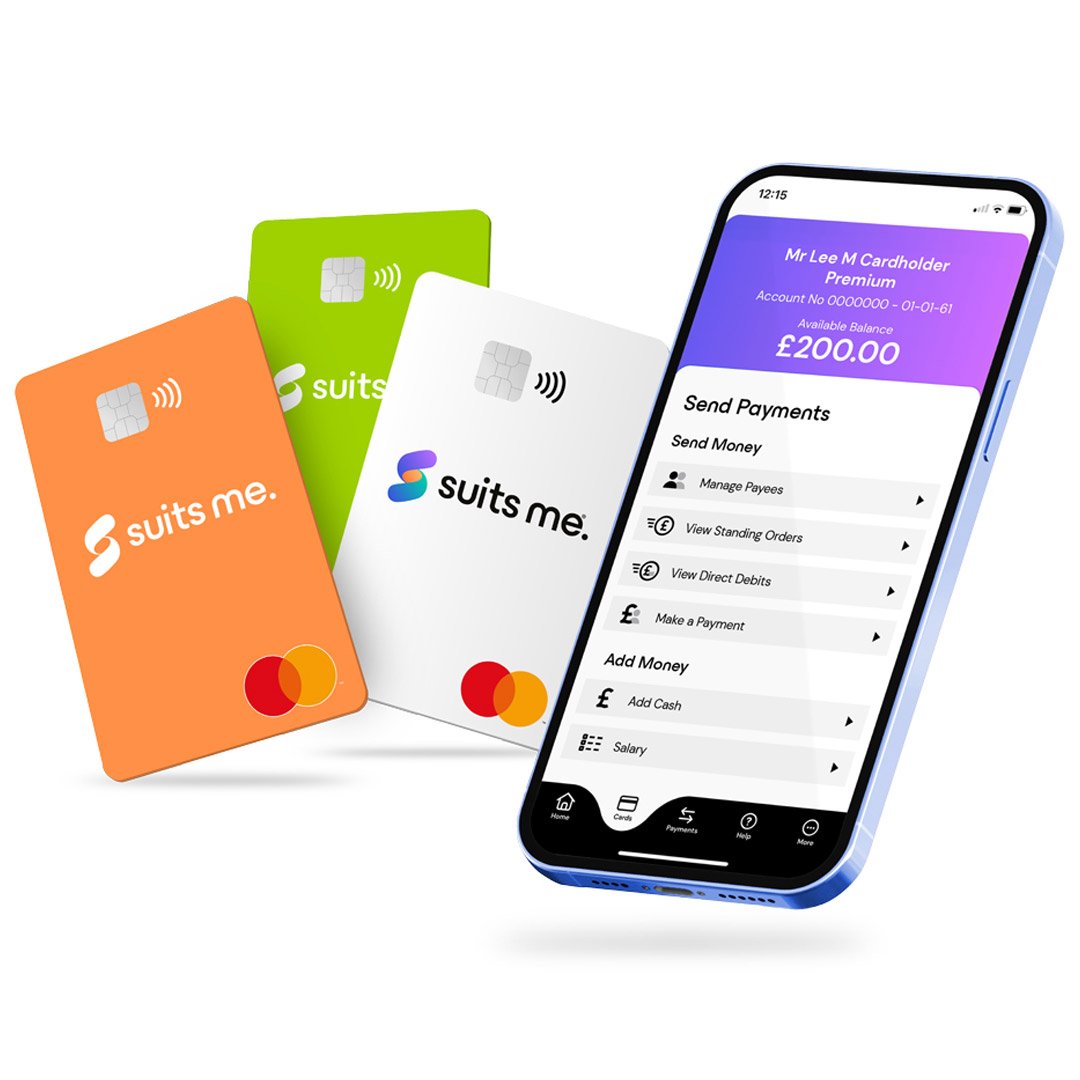

Open a Suits Me® account in minutes —a bank account alternative with no hard credit checks or overdraft.

✅ No credit checks

✅ Instant sort code & account number

✅ Easy online application

✅ Suitable if you’ve been rejected by bank

Struggling to get a bank account because of bad credit?

Open a Suits Me® account in minutes —a bank account alternative with no hard credit checks or overdraft.

✅ No credit checks

✅ Instant sort code & account number

✅ Easy online application

✅ Suitable if you’ve been rejected by bank

Why bad credit makes opening a bank account difficult in the UK

Having bad credit can make it difficult to open a bank account in the UK with a traditional bank. Why?

- They run hard credit checks

- They require 3 years verified address history

- They can reject people with CCJs, defaults, arrears or past missed payments

- They may freeze or restrict features if you’re in debt recovery

These systemic checks don’t consider real life: job changes, illness, temporary setbacks or unexpected bills.

But you still need an account to manage your money — and Suits Me® gives you that chance.

What “bank account for bad credit” really means

For many people with bad credit, there are a number of options available to provide you with an account to manage your money.

If you’ve been searching for a bad credit bank account, you may have come across prepaid accounts, basic accounts, or so-called second-chance options. While they’re often grouped together, they work in different ways.

Prepaid accounts let you spend only the money you load onto them in advance. Because you can’t borrow or go overdrawn, they’re often easier to open and don’t usually involve credit checks. However, some prepaid options have limited features and may not support everyday needs like direct debits or salary payments.

Basic accounts are usually offered by high-street banks. They’re designed for people with poor or limited credit history, but approval isn’t guaranteed. Many still carry eligibility checks, and features can be restricted compared to standard bank accounts.

Second-chance accounts is a broad term used for alternatives designed for people who’ve been declined elsewhere. These options focus less on credit history and more on helping you manage your money day to day, often with online access, a debit card, and support for regular payments.

Suits Me is a great choice when you have bad credit.

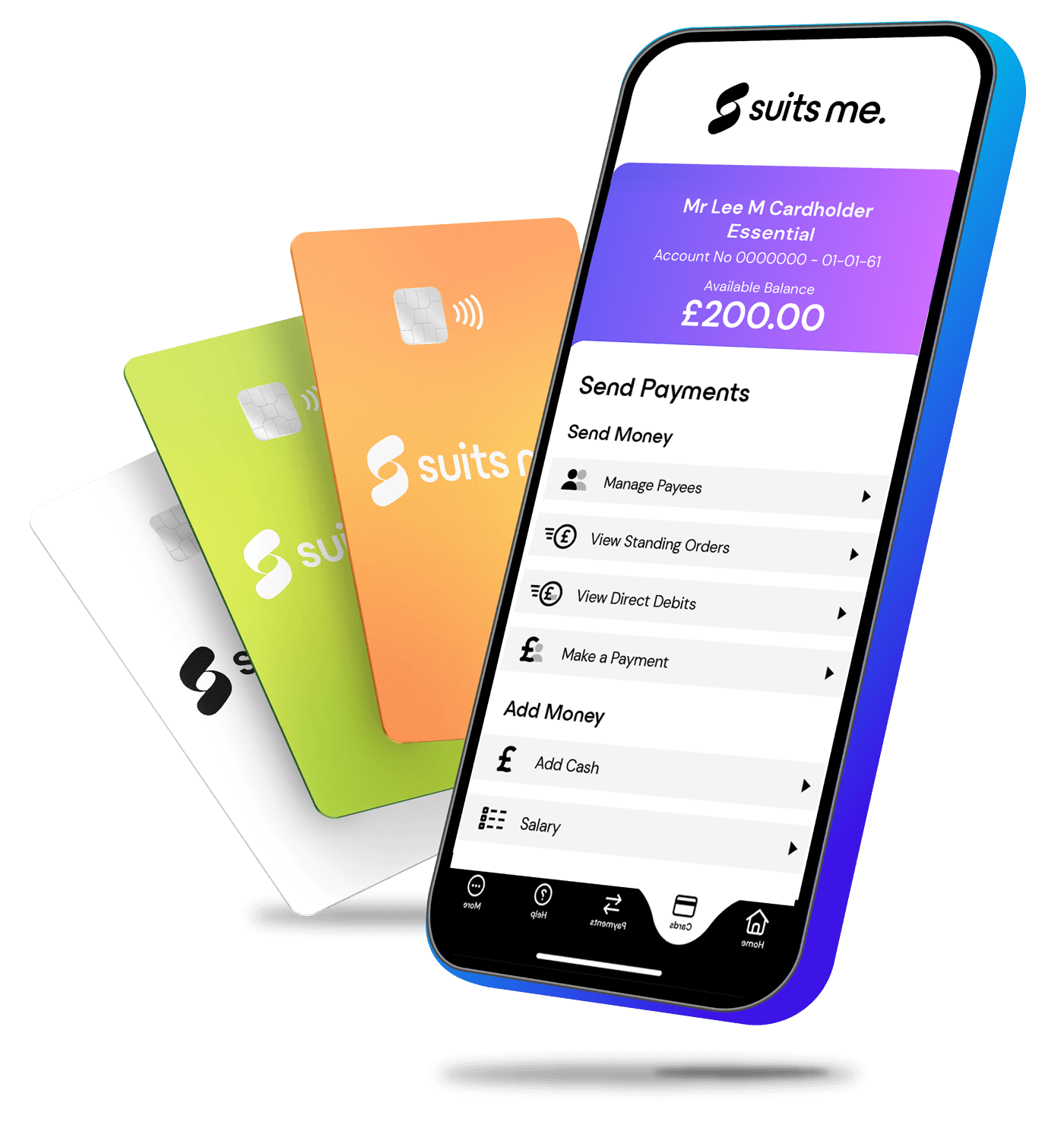

Your account gives you everything you need to manage your finances:

✅ No credit checks

✅ Receive wages, benefits or pension

✅ Pay bills by Direct Debit

✅ Set up standing orders

✅ Track spending through the mobile app

✅ Withdraw cash worldwide

✅ Send Faster Payments

✅ Access cashback on everyday spending

You get a fresh start without financial judgement.

Banks reject people with bad credit. Why?

Traditional banks can decline applications when they detect:

- Missed payments or credit defaults

- County Court Judgments (CCJs)

- High outstanding debt

- IVA or Debt Management Plans

- Bankruptcy (current or recent)

- Irregular or unstable financial history

- Past overdraft problems

These are common reasons people are declined when applying for a bank account with bad credit.

That’s where Suits Me® steps in as a bank account alternative for people with bad credit.

How Suits Me®

removes the common barriers to opening a bank account with bad credit

We focus on giving you access, not judging your past.

No credit checks

Your credit history does not affect your application.

No 3 years of address history

We don’t require 3 years verified proof of address.

No overdraft or borrowing

This keeps your account simple and low risk.

Quick online setup

Apply in minutes from your phone – no branch visits.

Designed for real-life financial experiences

From credit recovery to simple budgeting, your account works for you.

*subject to AML and regulatory requirements

Can I open a bank account IVA, DMP, CCJs, defaults & bankruptcy?

You’re still eligible

Your past financial events do not prevent you from opening an account with Suits Me®.

Here’s how mainstream banks see each situation — and why we handle it differently:

IVA

Banks may restrict accounts — we don’t.

DMP

Banks see it as ‘financial instability’ — we don’t.

CCJs

A major rejection trigger for banks — not for us.

Defaults

Bank systems automatically decline — Suits Me® does not assess applications based on credit history. .

Bankruptcy

Many banks refuse new accounts — you can open with us online.

If you’re rebuilding your finances, you don’t need a bank’s approval to move forward.

CIFAS markers: how Suits Me® helps

Being a victim of fraud can lead to unfair banking restrictions.

Many banks’ systems automatically reject applications when a CIFAS marker appears.

Suits Me® offers an accessible alternative, supporting people affected by impersonation or fraud-related blocks.

Who a bank account alternative for bad credit is designed for

This account is designed for people who:

- Have been rejected by banks

- Are recovering from debt

- Have poor or limited credit history

- Are in an IVA or DMP

- Are newly discharged from bankruptcy

- Have CIFAS concerns

- Need an accessible, everyday account

Suits Me® gives you financial independence — fast.

How to Open Your Account

Choose the right account for you

Essential

Back Up Account

pay as you go

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you.

For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

-

If you already have a main bank account and want a back-up personal account that’s easy to open and use, this account is perfect for you.

For occasional monthly spending with a pay-as-you-go flexible card and mobile app. If you are doing more than a handful of transactions each month our other accounts may be better for you.

Premium

Spending Account

£5.97 /month

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice.

Cashback, discounts, and everything you need to spend with ease.

-

For everyday spending you get more for your money with this account. If you are making regular transfers and drawing out cash, Premium will be a good choice.

Cashback, discounts, and everything you need to spend with ease.

Premium Plus

Main Account

£9.97 /month

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice.

Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

-

If you need an account for your wages and benefits, setting up regular payments or somewhere to pay cash in, Premium Plus is the best choice.

Enjoy full benefits, VIP phone queue jump, and maximum rewards. The ideal hassle-free alternative to a high-street bank for your main account.

Apply for your account online today – it takes just a few minutes!

Receive your account number & sort code immediately and your contactless Mastercard® debit card in 3–5 working days!

Start banking & earning cashback – no credit checks or hidden fees.

FAQs

What is a bad credit account?

A bad credit bank account is a term people use when looking for a way to manage their money after being declined by traditional banks. These are often basic accounts, prepaid accounts, or bank account alternatives designed to work without relying on a strong credit history.

Do bad credit bank accounts require a credit check?

Many alternatives to a bank account when you have bad credit do not require a credit check, as they don’t offer overdrafts or borrowing, Suits Me is an example. This can make it easier to open if you have poor or limited credit history.

Can I open an account with bad credit?

Yes, you can open an account with bad credit. For a full range of features to manage your money, a bank account alternative is a good choice.

Will opening a Suits Me account affect my credit score?

No. We do not run hard credit checks.

Can I get a bank account if I’m in an IVA/DMP or have CCJs?

Yes, these do not prevent you from opening an account.

Can I get paid wages into a bad credit bank account alternative?

Yes, Suits Me offer fully functioning accounts that allow you to receive salary payments and benefits, making them suitable for everyday use even if you’ve struggled to open a traditional bank account.

What if another bank rejected me recently?

You can still apply — previous rejections don’t affect us.

Do you offer overdrafts or loans?

No, we keep your account simple and safe.

Can I get paid into this account?

Yes — wages, benefits and payments can be sent directly to your account.