Internet banking has become increasingly popular over the last ten years. A survey conducted by Statista revealed that in 2019, 73% of banking customers utilised online banking facilities and as we continue to move further into the digital age that percentage is only set to increase.

Internet banking allows users to conduct financial transactions without having to visit a bank branch or speak to your bank over the phone. In the UK, the number of bank branches has roughly halved from 1986 to 2014 and closures expect to continue. So how can you start online banking before your local bank branch closes its doors?

What is Internet Banking?

Internet banking allows a user to manage their finances via the internet, eliminating the need to visit or call their bank in order to make payments or check their balance.

Also known as online banking or web banking, the service allows customers to access almost all the banking facilities offered inside a bank branch including bank transfers, the ability to manage direct debits, set up standing orders and make deposits.

Advantages of Internet Banking

There are several advantages to internet banking that make it the most popular way to manage finances, including:

It fits Around your Schedule

You can access your account 24/7 from anywhere in the world, meaning you can manage your payments on the go. Meaning you don’t need to worry about making it to the bank before closing time or taking time out of your day to deal with your finances.

Up to Date Information

You don’t need to rely on out of date, paper statements or call up your bank’s automated service, which can be unnecessarily time-consuming. Internet banking allows you to see it all in one place and provides you with the most relevant information

A Convenient Way to Make Payments

Instead of having to travel to your bank to make a payment, manage a direct debit or set up a standing order, you can do it all with a few clicks of a button from the comfort of your own home.

What can you use Internet Banking for?

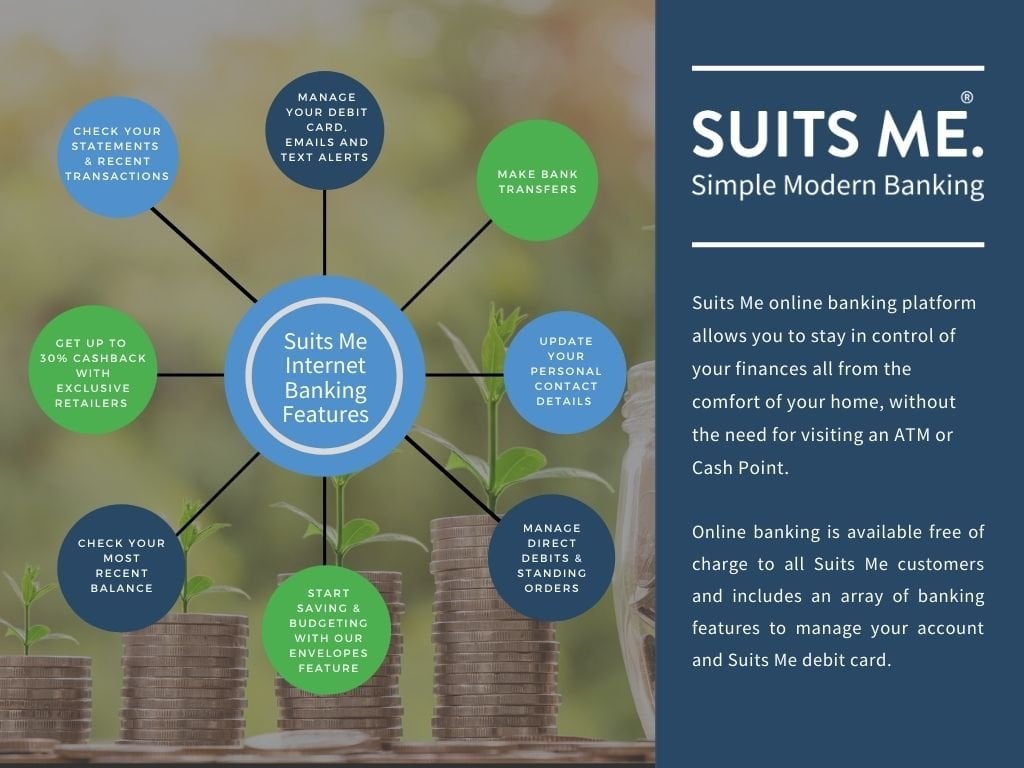

As previously mentioned, most internet banking platforms have all the same functions as a bank branch, minus the long queues and closing times. Some features of Suits Me®’s online banking platform include:

How to Set up Internet Banking?

To set up internet banking, you will need to contact your bank or building society who can send you the details you need either by post or email to get started. These details should include:

- Your username or customer reference number,

- Account number and sort code,

- A temporary password which you can then change to something more memorable,

- You may also need to set up other memorable information such as your first holiday, a pet’s name, or the name of your first school.

It’s important to keep this information safe and not kept within your wallet or purse, mobile phone or in any location that could your banking details at risk.

If your bank doesn’t have all the features you need on their internet banking platform or aren’t happy with the service provided, you may need to find a different bank account so you can manage your money online.

Is Internet Banking Safe and Secure?

To put it simply, yes internet banking is safe and a lot more secure than carrying around large sums of money around to deposit in a bank branch. However, some ways that could reduce the security of your account is if a criminal discovered your log in details or hacked your phone, computer, or bank.

However, banking websites are used to hackers attempting to breach their systems which is why they have extensive security measures in place to protect your money as it’s in their best interest to keep your money safe. If for some reason your account is hacked and your money is stolen, it’s likely you will be protected, and your money returned by your bank.

Suits Me®

Once you’ve opened a Suits Me® account, you will automatically receive your online account details as soon as your details have been verified (which is usually around 3 minutes) so you can start managing your finances immediately.

To learn more, read our support guide on how to set up your online account.