Living in the UK as an expat or foreign national?

Open a UK account in minutes with Suits Me.

No credit checks, no proof of address, no branch visit. Just a UK account that’s ready when you are — with support in 11 languages

Open your UK account easily

Moving to a new country comes with enough challenges — opening a UK account shouldn’t be one of them. Suits Me® makes it simple for newcomers to access a UK account, even if you don’t have a permanent address or UK credit history.

With a Suits Me® account, you can:

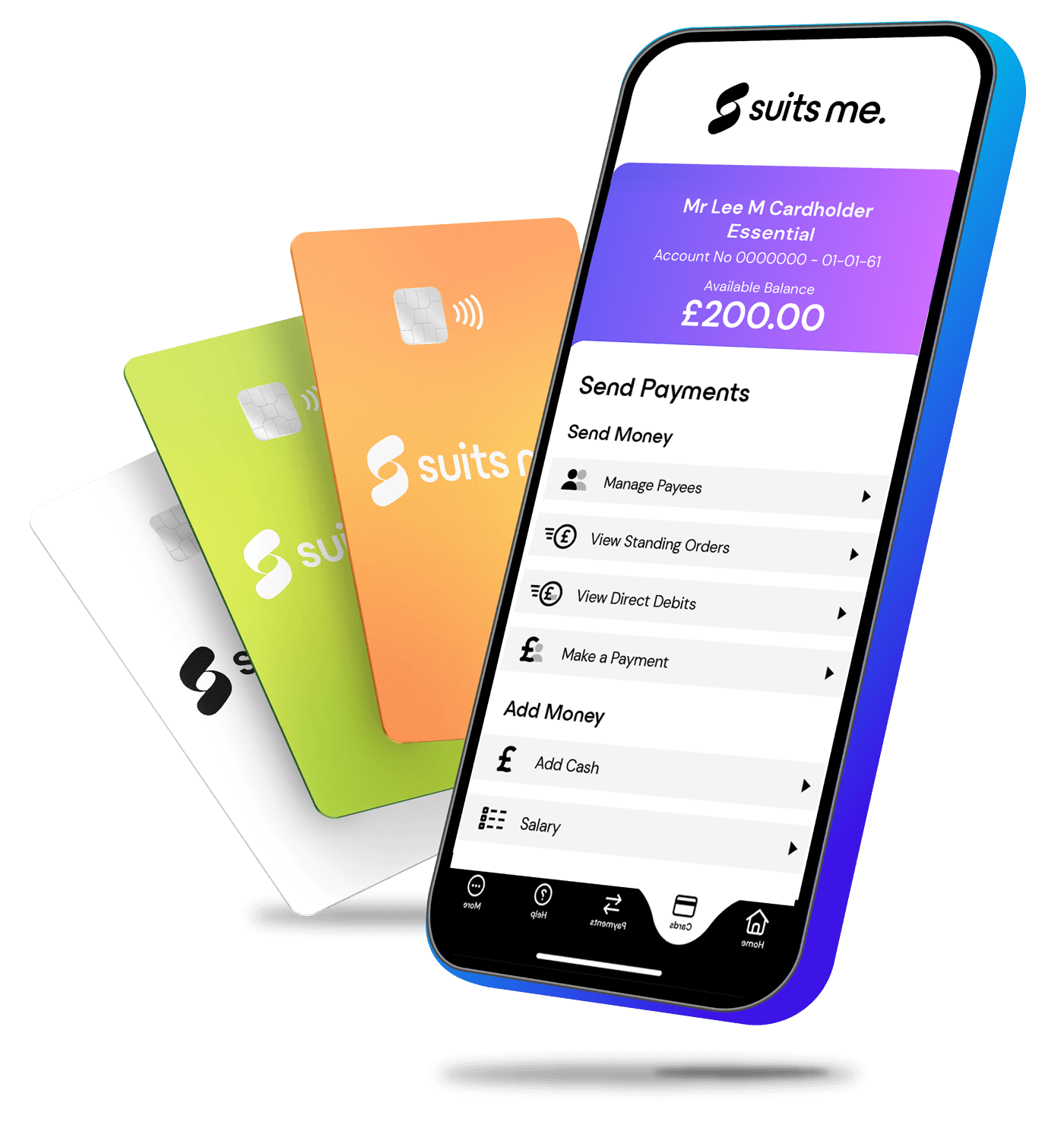

- Apply online in minutes and get your UK account instantly

- Receive a UK sort code and account number

- Use your contactless Mastercard® for spending, online shopping, and ATM withdrawals

- Pay bills, set up direct debits, and receive your salary

- Earn cashback rewards at participating retailers

Our accounts are ideal for expats, students, international workers, and anyone starting life in the UK.

Suits Me® is perfect for people new to the UK

No proof of address needed

Forget utility bills or tenancy agreements — all you need is a valid Photo ID and a UK address to open an account.

No credit checks

We don’t run credit checks, so your application won’t be affected by your credit history.

Fast online setup

Get your UK account details instantly after verifying your ID — no branch visits required.

Full account features

Pay bills, receive payments, set up standing orders, and use your contactless Mastercard® anywhere in the UK.

Trusted & secure

Suits Me® is regulated, and your funds are held securely in segregated accounts.

Who can benefit from a Suits Me® account?

- New arrivals to the UK with no previous UK bank account

- Students or young professionals moving for work or study

- Expats, temporary residents, or people between homes

- Anyone struggling to open a traditional UK account

What documents do foreign nationals need to open a Suits Me® account?”

Most high-street banks ask for two forms of UK address proof — typically a utility bill and a bank statement dated within the last three months. For someone who has recently arrived, or who has moved address, this can be impossible to provide quickly.

Suits Me® takes a more flexible approach. You’ll need:

- A valid photo ID — passport, national identity card (EU/EEA), or full UK driving licence

- A UK address to receive your card (this can be a friend, family member, or employer’s address if you don’t yet have your own)

- A selfie for identity verification

You do not need: utility bills, tenancy agreements, council tax letters, a UK credit history, or a minimum opening deposit.

Why People Trust Suits Me®

- Regulated and fully secure

- Thousands of customers trust Suits Me®

- Transparent fees with no hidden charges

- Cashback rewards on everyday purchases

Suits Me® is the easiest, safest, and fastest way for people new to the UK to start managing their money.

FAQs

Can I open a UK account if I’ve just arrived in the country?

Yes. You don’t need long-term residency or UK credit history to apply for a Suits Me® account.

You can start the process as soon as you arrive, using the documents you already have.

Do I need UK proof of address to open an account?

Not always. Many newcomers don’t yet have utility bills or rental agreements in their name.

Suits Me® accepts alternative documents depending on your circumstances, so you can still apply even if you’re staying with friends, family or in temporary accommodation.

What identification do I need as someone new to the UK?

You can verify your identity with a range of documents, such as a passport, national ID card or other accepted alternatives. Your exact requirements will be shown during the application process.

Can I get a UK account without a UK credit history?

Yes. Suits Me® does not rely on UK credit history to assess your application, making it suitable for people who are new to the country.

Can I receive my salary into a Suits Me® account if I’m new to the UK?

Yes. Once verified, you’ll receive UK account details that you can give to your employer, agency or benefits provider.

Can international workers or expats use Suits Me®?

Yes. Suits Me® is suitable for people moving to the UK for work, study or family reasons — even if they don’t have UK documents yet.

How quickly can I get my UK account details?

After completing the online verification steps, you’ll receive your sort code and account number so you can begin using the account for payments and income.

Can I apply if my home-country documents are in a different language?

Yes. Many non-UK documents are accepted. If anything needs clarification during verification, you’ll receive guidance on what to provide next.

What if I don’t have a rental agreement or utility bills yet?

That’s common for people who are new to the UK. During your application, you’ll see a list of alternative documents that can be used instead.

Can students new to the UK apply?

Yes. Suits Me® is suitable for international students who need a UK account to receive money from family, pay rent or manage everyday spending.

Can I use the account before I receive my debit card?

Yes. Once verified, you can start receiving money and making transfers using your online account. Your physical debit card will arrive shortly after.

Does being new to the UK affect what features I can use?

No. Once your account is verified, you can use all standard features such as transfers, Direct Debits, standing orders and the mobile app.

Can I set up Direct Debits as someone new to the UK?

Yes. After verification, you can set up Direct Debits and standing orders to pay rent, subscriptions, childcare, phone bills and more.

Is Suits Me® suitable if I’m waiting for my BRP?

Yes. You don’t need to wait until your Biometric Residence Permit arrives to begin the application. Alternative documentation may be used.

Can newcomers open a UK account from overseas?

You can start the application before moving and complete verification once you arrive in the UK with your accepted documents.

Can I open a UK bank account as a foreign national without a credit check?

Yes. Suits Me does not run credit checks as part of the application process. Whether you’ve just arrived in the UK or have been living here for years without a UK credit file, your application won’t be assessed on credit history.

What is the easiest UK bank account to open as a foreign national?

For foreign nationals already living in the UK, the easiest accounts to open are those that don’t require proof of UK address, a credit check, or a minimum deposit. Suits Me is one of very few accounts that meets all three criteria — you can complete the entire application online in minutes, using just a photo ID and a UK address to deliver your card to.