Looking for a bank account?

Suits Me offer something different.

An alternative to a bank account with all the features you need to manage your money.

✅ No credit checks

✅ Account opening in minutes

✅ No minimum deposits

✅ Rewards as standard

Suits Me offer something different.

An alternative to a bank account with all the features you need to manage your money.

✅ No credit checks

✅ Account opening in minutes

✅ No minimum deposits

✅ Rewards as standard

Join the thousands of people who wanted something different to a bank account

They chose Suits Me, and got a personal account

to suit them.

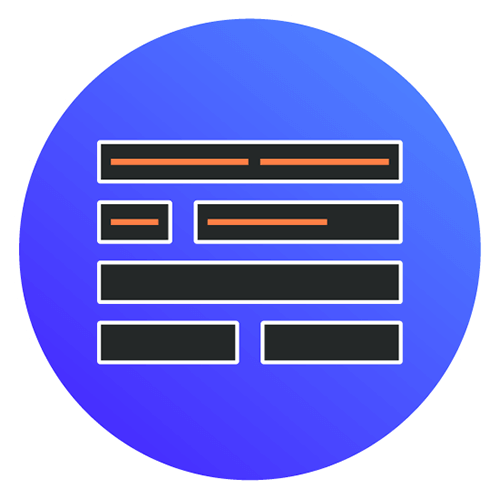

Bank account vs Suits Me account

We provide the features you need to manage your money, without any hassle.

Account feature |

Suits Me |

High Street Bank |

| No credit checks |  |

x |

| Open online in minutes |                       |

x |

| No photo ID required* |                       |

x |

| No verified proof of address required |                       |

x |

| Unlimited cashback rewards |                       |

x |

| No minimum deposit |                       |

|

| Contactless payments |                       |

|

| Mobile App |                       |

|

| Direct Debits & standing order |                       |

|

| Transfers locally & internationally |                       |

|

| Discounts on top brands |                       |

|

| Virtual customer service |                       |

|

| Multilingual customer service |                       |

|

Choose the right account for you

Essential

Best for occasional use

Pay as you go /month

-

Essential is our pay as you go card. An instant account to give you flexibility and control when you need a separate account. Our customers who need an account to use now and again rather than as a main account choose Essential. Although there is no set monthly fee, individual charges are higher than the other account types. Overall monthly costs can be higher than our other account types if used as a main account or high volumes of payments.

-

Essential is our pay as you go card. An instant account to give you flexibility and control when you need a separate account. Our customers who need an account to use now and again rather than as a main account choose Essential. Although there is no set monthly fee, individual charges are higher than the other account types. Overall monthly costs can be higher than our other account types if used as a main account or high volumes of payments.

Premium

Best for basic use

£4.97 /month

-

Our Premium account is packed with extras. This account will let you do everything you need to manage your money whilst giving you cashback and discounts. Customers who need a basic and functional account for wages and benefits or have multiple payments into their account choose Premium.

-

Our Premium account is packed with extras. This account will let you do everything you need to manage your money whilst giving you cashback and discounts. Customers who need a basic and functional account for wages and benefits or have multiple payments into their account choose Premium.

Premium Plus

Best for main account

£9.97 /month

-

Our Premium Plus account is loaded with value plus you receive our VIP queue jump service. This account is a favourite with our customers with its inclusive package. The Premium Plus account is normally the cheapest option for those who want a fully functional bank account replacement as average usage is all included.

-

Our Premium Plus account is loaded with value plus you receive our VIP queue jump service. This account is a favourite with our customers with its inclusive package. The Premium Plus account is normally the cheapest option for those who want a fully functional bank account replacement as average usage is all included.

Why choose Suits Me

We provide an account that works for you.

We don’t ask for 3 months verified proof of address*, we don’t conduct credit checks and we don’t ask for minimum deposits to unlock rewards. There’s no overdrafts, so you can better manage your money.

Our customer service is award-winning. We don’t use chatbots, we speak your language and we use real people who understand your needs.

If your circumstances change, we won’t charge to close your account.

*subject to AML and regulatory requirements

Open your account

Join the thousands of people changing their lives

Nesha’s story

Eddie’s story

Peter’s story

Awards

British Bank Awards

Best Current Account Provider 2022 Finalist

SME News

Most Innovative Banking Service 2023

British Bank Awards

Best Newcomer 2020 Highly Commended

As seen on

BBC

Dave

Yahoo Finance

Sky Atlantic

Evening Standard

Daily Mail

Mirror

Benefits of a Suits Me account

Open an account in minutes

Our advanced technology allows us to open accounts in minutes online with the ID that YOU have.

Safe & secure

Your account safety, money and personal data is our highest priority. We ensure your identity, funds and personal information is safeguarded at all times.

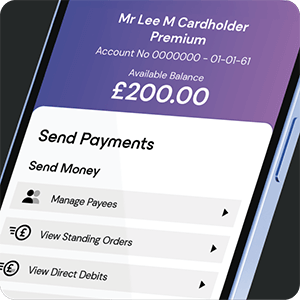

Send & receive payments

Receive and send money in the UK and abroad easily. Our Faster Payments are seriously fast and can all be done self serve via our app.

Exclusive discounts with top brands

Access our exclusive customer discounts with top brands when you have an account with Suits Me. New partners are added every week for you to enjoy.

No minimum balances

There are no minimum deposits or balances required to open a Suits Me account and enjoy all the benefits.

Standing orders & Direct debits

You can pay Direct Debits and set up Standing Orders from your account.

Easy to use mobile app

Our Mobile App allows you to manage your finances on the go. Instant notifications on spending and deposits to your account.

International transfers

With our preferred partner, Remitly, you can easily make international payments and receive international transfers into your Suits Me account.

Wages & benefits

Provide your sort code and account number to your employer or benefits provider to have funds transferred directly into your Suits Me account.

Accounts that suit you

Suits Me make it easy to apply for a personal account and we reward our customers as standard. Our accounts are designed to suit you. It’s all in the name. Easy to apply, easy to use and so many extras and discounts offered exclusively to our customers.

Some of our customers simply want a separate account to enjoy all the benefits we bring to them, including cashback and top brand discounts.

We provide all the features you need to manage your money and with no credit checks, we provide them to everyone who needs them. We remove the barriers that prevent thousands of people from opening a current account.

Whatever your situation, we’ve got you.

Open your account

Trying to open a bank account online?

It can be difficult to open an account if you don’t have the ID or documents required by banks. Suits Me are not a bank. We can offer instant accounts to those who don’t fit the ‘norm’. We embrace being different and we love being inclusive.

Eligibility: If you are over 18 and live in the UK, you can apply for a Suits Me Account. Subject to AML regulatory requirements.

Instant accounts whatever your situation

| Bad credit Bad credit can be a barrier to opening a bank account or accessing an account with rewards. Not with Suits Me. We support thousands of people who have bad credit and help them with an easy to use instant account. |

Bankrupt Dealing with debt is hard. If you have been made bankrupt, Suits Me can provide all the banking-like features you need. We make it easy to open an account and there is no risk of further debt. |

IVA If you are entering into or already in an IVA, it is best to open a new account. Suits Me provide fresh start accounts in minutes, getting you back on track with your finances. |

| No Credit Checks We do not conduct credit checks when you open an account with Suits Me. As we do not offer credit, we do not need to make a mark on your credit file. If you are entering into or already in an IVA, it is best to open a new account. Suits Me provide fresh start accounts in minutes, getting you back on track with your finances. |

No Verified Proof of Address* Situations change and often our customers find that they don’t have the required documentation to prove their address. We don’t need you to provide 3 months proof of address to open a Suits Me account. |

No Photo ID* No passport or driving license? Not a problem. You can open a Suits Me account with a selfie and other alternative ID. As it is online, there is no need to post documents or visit a bank, and you can apply in minutes. |

| New to the UK Suits Me support those new to the UK by removing the challenges of opening a bank account. We accept the ID* you have on arrival and confirm your application online. With customer support in 19 languages, we can provide help in a language that suits you. |

CIFAS Markers CIFAS Markers can prevent you from opening a bank account. If you have been a victim of impersonation this can be very frustrating and unfair. We help those who are in this situation and need to open an account quickly online due to the closure of their previous account. |

Asylum Seekers We understand that arriving into the UK from overseas is difficult. Often, not having the required documents is a barrier to getting a bank account and starting your new life. With Suits Me, you can open an account online in minutes, with just a selfie and an ARC card *. Find out more… |

| Students Our accounts are perfect for students who want to get cashback and access discounts. With no minimum deposits you can use our accounts to suit you needs. |

Gambling If you are looking to manage your gambling spending, Suits Me accounts can be set up in minutes and allow you to budget more effectively. Many Suits Me customers use our accounts to ensure gambling funds are kept separate from their main bank account. |

Gaming If you are looking for an account for online gaming, look no further. A separate Suits Me account can be set up in minutes and you can better manage your gaming spend. |

FAQs

What ID do I need to open a bank account?

Banks require a proof of identity document and proof of address.

Proof of identity needs to be Photo ID and proof of address needs to be either a utility bill, council tax or bank statement.

Suits Me do not require proof of address or photo ID to open an account*. We accept many alternatives.

*subject to AML regulatory requirements

Why do I need to provide ID?

You need to provide ID to enable account providers to prevent fraud and money laundering. You need to prove your identity when you apply for a bank account. Suits Me offer so many alternatives to ensure you have the opportunity to open an account with us.

How much money can I withdraw from my account?

Spend limits

Essential account

ATM withdrawals limits per day – £200

Max single Card transaction limit – £5,000

Max Card transactions limit per day – £5,000

Max Card transactions per week – £10,000

Max Faster Payment out limit per transaction – £5,000

Premium account

ATM withdrawals limits per day – £300

Max single Card transaction limit – £7,500

Max Card transactions limit per day – £7,500

Max Card transactions per week – £15,000

Max Faster Payment out limit per transaction – £5,000

Premium Plus account

ATM withdrawals limits per day – £500

Max single Card transaction limit – £10,000

Max Card transactions limit per day – £10,000

Max Card transactions per week – £20,000

Max Faster Payment out limit per transaction – £5,000

Does the account have an overdraft?

No, Suits Me do not offer over drafts with accounts.

How long does it take to open an account?

Our accounts can be opened in minutes online.

How do I transfer money to another bank account?

It’s really easy to transfer money to another bank account using our app. Simply select add Payee using the full name of the recipient, account number and sort code and add an amount. Your transfer will be received in less than 2 hours.

How often do DWP check bank accounts?

DWP will only check bank accounts if fraudulent claims are suspected. Currently the mainstream banks are the primary account providers that will be checked.

Can I open a bank account online?

If you have the correct ID and a sufficient credit score you can open a bank account online. If you do not, it is unlikely you can open an account online with a mainstream bank.

You can open an account with Suits Me online, whatever your situation.

How many bank accounts can you have?

There are no limits on the number of bank accounts you wish to have. It depends on your preference and financial habits.

How do I deposit cash into a bank account?

For a mainstream bank account you will need to go to your nearest branch.

To add cash to your Suits Me account you can visit and Post Office or PayPoint.