Contactless payments have become one of the most popular ways to pay, allowing people to make quick and secure purchases by simply tapping their card or mobile device.

But how much can you actually spend without entering your PIN? The contactless limit varies depending on where you are in the world, the type of card or wallet you use, and the rules set by card issuers and regulators.

In this guide, we explain what the contactless payment limit is, the current contactless limit in the UK, how limits differ globally, and what changes are expected under new UK regulations.

What Is the Contactless Limit?

The contactless payment limit is the maximum amount you can spend in a single transaction by tapping your card or device, without needing to enter your PIN.

Contactless limits exist to:

- Reduce fraud if a card is lost or stolen

- Protect consumers from unauthorised spending

- Balance convenience with payment security

In addition to per transaction limits, card providers may also require a PIN after multiple contactless payments as an extra safety measure.

What Is the Contactless Limit in the UK?

The UK contactless limit for physical debit and credit cards is currently £100 per transaction.

This applies to most:

- Debit cards

- Credit cards

- Prepaid debit cards

However, individual banks and card issuers may:

- Set lower limits

- Ask for a PIN after repeated tap payments

- Apply additional fraud prevention checks

This is why you may sometimes be asked to enter your PIN even if the amount is below £100.

2026 Regulatory Update: Changes to UK Contactless Limits

From March 2026, the UK’s national £100 contactless limit will be removed.

Instead of a fixed nationwide cap, banks and card providers will be allowed to set their own contactless payment limits, subject to regulatory safeguards.

What this may mean for customers:

- Some providers may keep the £100 limit

- Others may introduce higher or lower limits

- Security and fraud monitoring will still apply

This change is designed to give providers more flexibility while maintaining consumer protection.

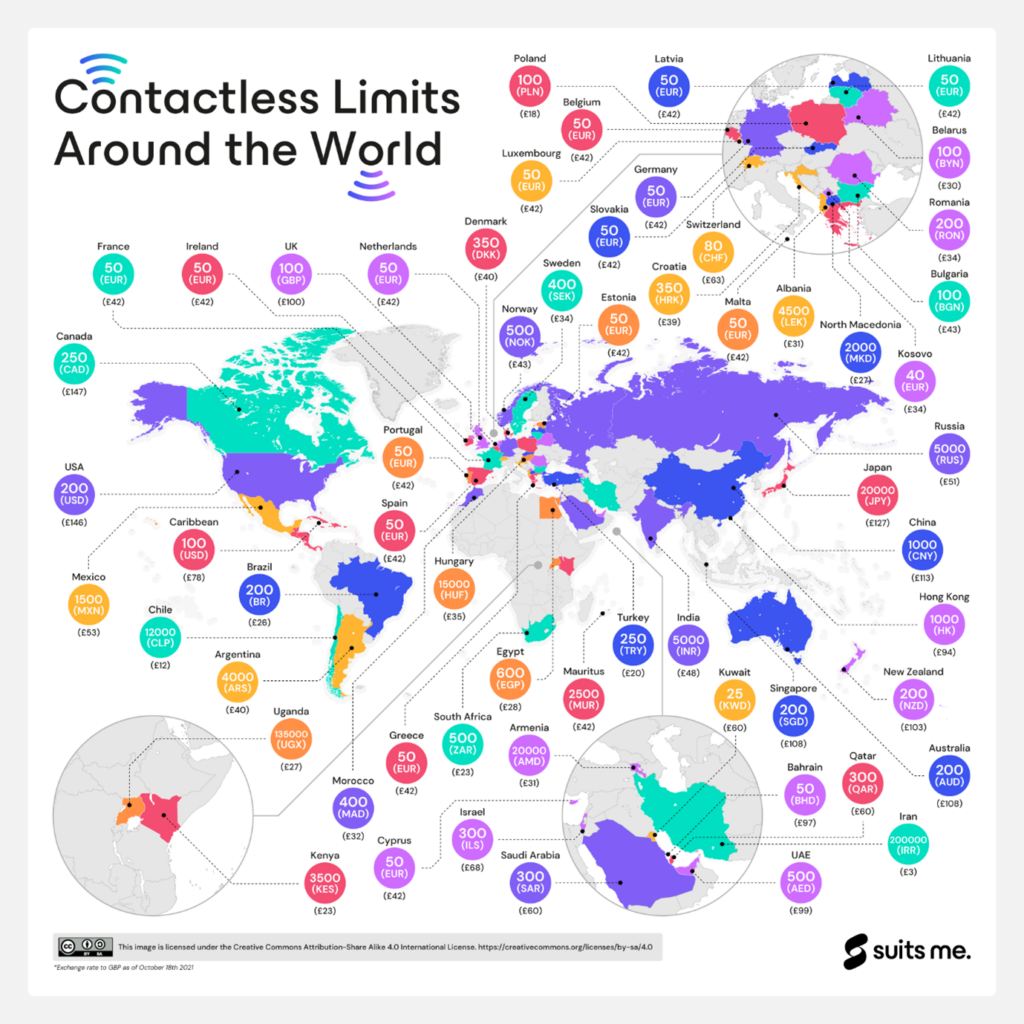

Contactless Payment Limits Around the World

Contactless limits vary widely by country due to differences in regulation, fraud risk, and payment infrastructure.

Europe

Many European countries have lower contactless limits than the UK, often around €50 (£40–£45) per transaction.

North America

Countries such as Canada and the United States often allow higher contactless spending, with limits set by card issuers rather than national regulation.

Asia-Pacific

Several Asian countries, including Japan and Singapore, allow higher contactless spending limits, particularly when mobile wallets are used.

Middle East, Africa & South America

Limits vary significantly, with some countries having very low caps and others applying flexible issuer-based limits.

Contactless Limits by Country (Approximate)

| Country / Region | Typical Contactless Limit | Notes |

|---|---|---|

| United Kingdom | £100 | Standard physical card limit (changes expected from March 2026) |

| Eurozone (France, Spain, Germany) | €50 (~£42) | Common across many EU countries |

| Switzerland | CHF 80 (~£63) | One of the highest limits in Europe |

| Sweden | SEK 500 (~£34) | Lower than UK and Switzerland |

| Poland | PLN 100 (~£18) | One of Europe’s lowest limits |

| United States | Issuer-based | Limits vary by bank and merchant |

| Canada | CAD 250 (~£145) | One of the highest standard limits |

| Japan | ¥20,000 (~£125) | Higher limits common in Asia |

| Singapore | SGD 200 (~£108) | Widely used for daily spending |

| Australia | AUD 200 (~£108) | Similar to Singapore |

| New Zealand | NZD 200 (~£103) | Slightly above UK level |

| United Arab Emirates | AED 500 (~£99) | Close to UK limit |

| Iran | Very low (~£4) | One of the lowest limits globally |

⚠️ Limits vary by provider and may change over time. Always check with your card issuer before travelling.

Why Do Contactless Limits Vary by Country?

Contactless limits are influenced by several factors, including:

- National fraud prevention strategies

- Consumer protection laws

- Adoption of mobile payments

- Banking infrastructure and technology

- Card network rules (e.g., Mastercard or Visa)

There is no single global standard, which is why limits differ widely worldwide.

Apple Pay Contactless Limit Explained

When using Apple Pay, transactions are authenticated using Face ID or Touch ID.

Because of this added security layer:

- Apple Pay payments may not always follow the same per-tap limits as physical cards

- Higher value payments may be allowed depending on the issuer

- Merchant and bank rules can still apply

The Apple Pay contactless limit depends on your card provider, merchant policies, and local regulations.

Google Pay Contactless Limit Explained

Google Pay works similarly, using device authentication to verify payments.

As with Apple Pay:

- Some payments may exceed the standard physical card limit

- Issuer and merchant controls still apply

- Extra security checks may be triggered for higher risk transactions

Mobile wallets often provide more flexibility while maintaining strong security protections.

Using Contactless Payments with a Suits Me Debit Card

Contactless payments make everyday spending quicker and easier, whether you’re shopping in the UK or travelling abroad.

With a Suits Me debit card, you can make contactless payments wherever Mastercard is accepted and manage your money securely through your online account and mobile app.

FAQs

What is the contactless limit?

The contactless limit is the maximum amount you can spend in a single tap payment without entering your PIN.

What is the contactless limit in the UK?

The UK contactless limit for physical debit and credit cards is currently £100 per transaction, although rules may change from March 2026.

Why do I sometimes need to enter my PIN even below the limit?

Banks may request a PIN after repeated contactless payments or when a transaction is considered higher risk.

Is the Apple Pay contactless limit the same as card limits?

Not always. Apple Pay uses biometric authentication, which may allow higher-value payments depending on your bank and merchant rules.

Does Google Pay have a contactless limit?

Google Pay may allow higher payments due to added device security, but issuer restrictions can still apply.

Do contactless limits vary when travelling abroad?

Yes. Contactless payment limits vary significantly by country depending on local regulations and fraud prevention policies.