Whether failing to budget or impulse buying, overspending is easily done. But with some simple strategies, we’ll show you how to avoid overspending and reach your financial goals!

1. Work out where your money is going

The average Brit has £889 per month of disposable income. Working out where yours is going is key to understanding how to stop overspending!

Take the time to sit down and record all your outgoings. You can then group them into fixed essentials, i.e. costs that don’t change from month to month like rent or mortgage payments, and variable essentials, like groceries and transport. Finally, variable non-essentials include eating out, clothes and holidays, as well as small treats like pre-work coffees.

Having a better understanding of what you currently spend will help you work out exactly where you can make savings.

2. Avoid your spending triggers

The process of budgeting should help you spot your spending triggers. Recent studies suggest that we’re becoming a nation driven by impulse, with 78.2% of people succumbing to unplanned online purchases.

Think about whether your spending is driven by certain moods or environments. Do you tend to buy mindlessly when you’re bored, or are you swayed to spend by social media influencers? Or maybe it’s the lure of a discount that comes straight into your email inbox…

Once you’ve figured out what your spending triggers are, you can create new habits. This could be unfollowing people, unsubscribing from company emails, or even switching your phone off in the evening.

3. Use a prepaid card

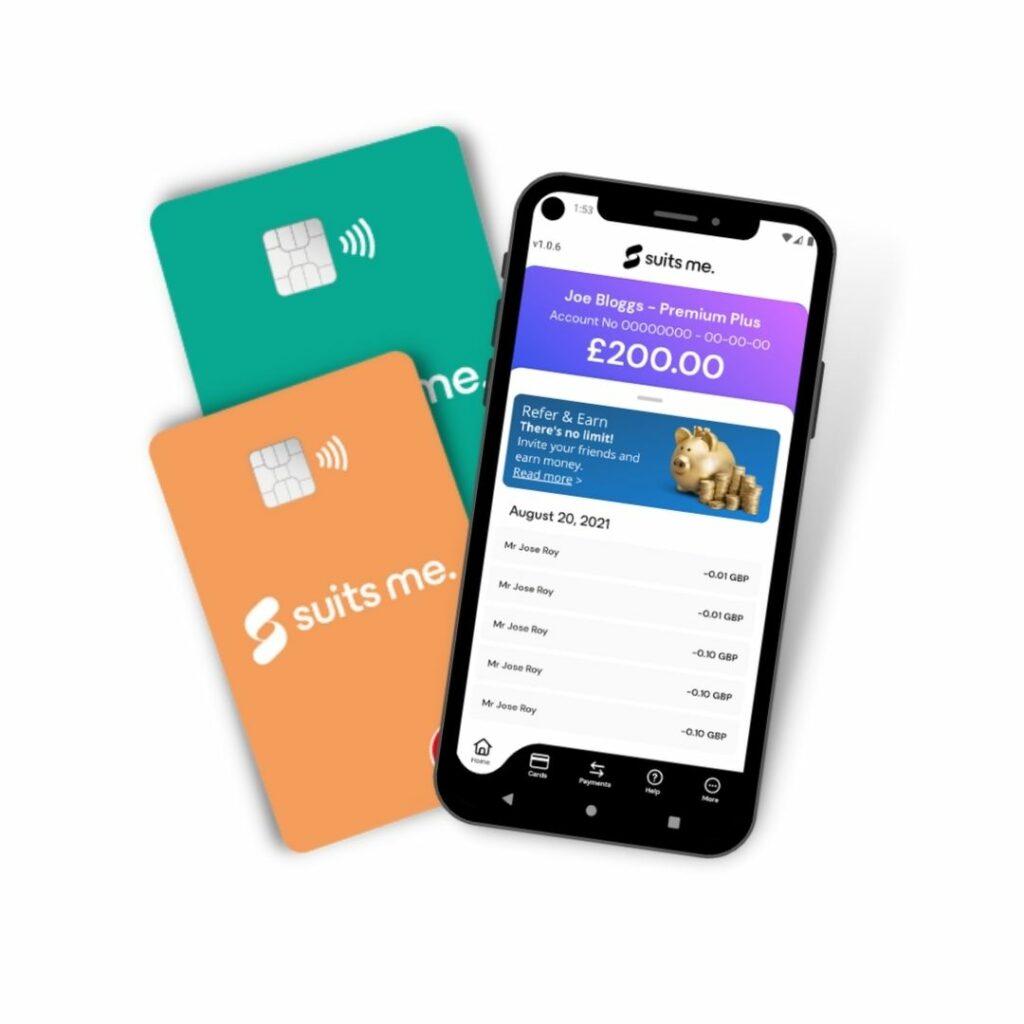

A prepaid card is one of the easiest ways to learn how to stop overspending. Once you’ve worked out what money you have available, give yourself a weekly or monthly budget and load that amount onto your prepaid card.

We’ve made budgeting super simple with the Suits Me® app. Simply load your card with your allotted amount and keep track of your spending throughout the month. It also makes it easy to spot where you could be overspending by tracking transactions.

You can open an account online in under 3 minutes and get a free contactless prepaid Mastercard® card a few days later.

4. Make shopping lists

Impulse buying is easily done when shopping – especially if you’re wandering through aisles without a plan. That’s why it’s crucial to make shopping lists. Even if you’re heading into town to buy clothes, take stock of what it is that you actually need and try not to deviate from it.

You can take this tip a step further by allocating spending limits to different items. And if you feel yourself getting distracted, simply reread your list and refocus your mind.

If you find the sweet aisle too much of a draw, then why not switch to an online weekly shopping service? That way you’re less likely to get diverted and you’ll know how much your weekly shop is costing before you get to the checkout.

5. Set financial goals

Financial goals are helpful tools for avoiding overspending. Are you saving for a house deposit for example, or hoping to book the holiday of a lifetime? Or maybe you’ve got a baby on the way?

Whatever you’ve got planned, having a clear goal will give you the motivation you need to save. Write down your short and long-term targets and work out how much you need to save each month to achieve them.

Don’t forget to check in on those goals regularly to make sure you’re still on track or tweak them if necessary.

6. Wait before buying

If you’re easily swayed by impulses or offers, get into the habit of waiting 24-48 hours before buying. Taking this time will give you pause for thought and allow you to question the purchase. If by the end of the allotted time you’ve forgotten about the item, then chances are you don’t need it!

You could ask yourself how a purchase will enhance your life and even work out the cost per use. If you’ll use something so much that the price becomes negligible, it could be worthwhile spending the money. But if you’re only likely to use an item a handful of times, it might not be a great investment and you could be better off saving your money.

Making mindful decisions like this could help you become mindful in other areas of your life too!

Avoid overspending with the help of Suits Me®

We’ve made sensible spending simple with our prepaid card and accompanying app. Apply for a Suits Me® account today and discover how to stop overspending with its handy features.