In the UK, banks allocate a sort code to each bank account. You will need to share this sort code when providing your account details to receive a payment. We all use these sort codes, but do you know how they actually work?

Below, we explain what it is and how it works to help you better understand your financial transactions.

What Does a Sort Code Do?

It helps process payments quickly and effectively by sharing specific numbers that indicate the location of your bank and branch.

Also provides details about the origin of a payment or the recipient of funds in a recognized UK account. If you input an incorrect sort code, you cannot send money until you verify the information is correct.

The lead pair in a sort code, comprising the first two digits, facilitates the accurate routing and settlement of cheque and credit payments. When utilizing alternative payment methods, all six digits of the sort code are considered to ensure funds are directed to the correct recipient’s bank account. This comprehensive sorting mechanism ensures payments reach their intended destination efficiently and accurately.

Where Can I Find My Sort Code?

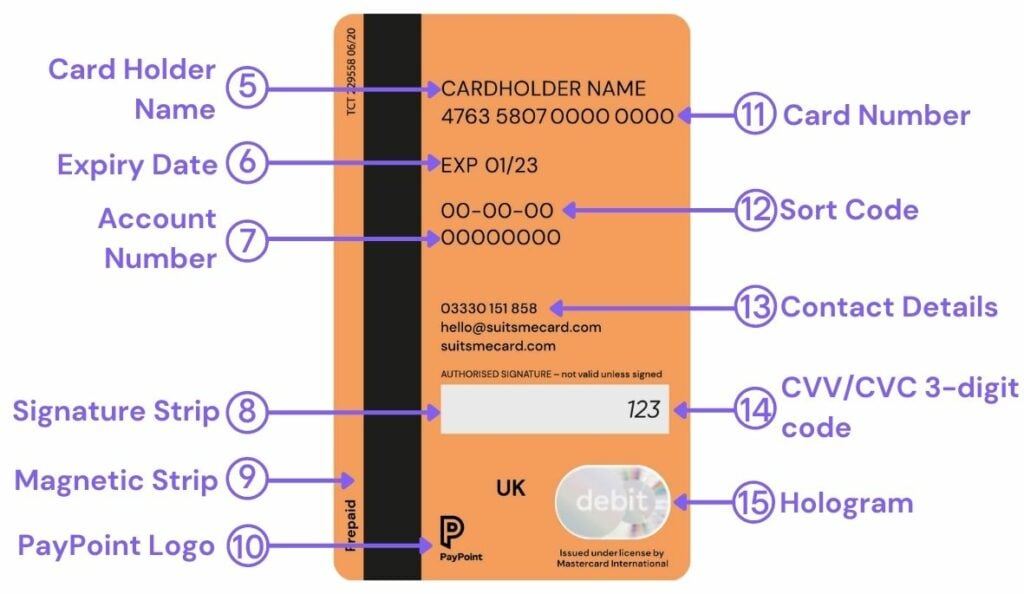

You are able to find this on your bank statements, cheque book, your mobile banking app, your online banking account or in some cases, on your debit card.

You will need to provide the sort code every time you want to set up a new payment route for your bank account. Meaning that this number is a particularly important part of your banking.

- Read our debit card features and functions guide to find where you can find your sort code on a Suits Me debit card.

Does My Sort code Stay With Me Forever?

A bank assigns a sort code to your account, and you will retain it only as long as you maintain that specific bank account..

If you choose to move banks, building society or alternative banking provider you will receive a new account number and sort code and must use these new details when amending payments or setting up new ones.

Is my Sort Code Private?

No! You can access a full list of all bank sort codes online as they aren’t tied to a specific account and don’t disclose personal details. The purpose of them is to identify the bank and branch rather than an individual account, so it is perfectly safe to share it.

Sort codes are crucial for British banking; learning yours facilitates hassle-free payments.

You should expect to input it when you are setting up a new direct debit or if you are receiving a payment from another source such as a bank transfer or standing order.

When paying by cheque, you don’t need to provide yours because it’s already printed on your cheque book.

Alternative Accounts with Suits Me

At Suits Me, we aim to stay current with emerging technologies to meet our account holders’ evolving needs. Our commitment ensures we provide modern solutions for our customers’ requirements.

Our accounts are personal accounts where you’ll receive a contactless Mastercard® debit card, access to online account and a mobile app to manage your finances on the go, from anywhere in the world, 24/7.

Once you have opened an account with us, you will gain access to a multitude of banking-like features to ensure you can manage your finances with ease, including:

- The ability to set up standing orders and manage direct debits,

- Send money within the UK via a transfer, international transfers are available via a partner in the Suits Me app,

- Gain access to our exclusive cashback reward programme where you’ll automatically get a percentage of your money back when you use your Suits Me debit card with our retail partners.

Opening an account with us takes ten minutes, there are no credit checks and we don’t ask you to provide proof of address.