Whether we’re paying in cash or making a transaction using our debit card, we use currency every day. The United Nations recognise over 180 currencies across the globe, with the oldest currency still in circulation being the Great British Pound (GBP) which dates back to the 8th century.

In this blog post, we discuss what currency actually is and why different currencies have different values.

Simply, what is Currency?

We use currency to measure the value of various goods and services in an economy. More simply, it’s money in the form of notes and coins, or more recently cryptocurrencies have become another form of currency to be aware of. Currency is convenient as it stands the test of time and it’s also portable, and exchangeable.

However, there are differences between money and currency. The main distinction being that currency doesn’t actually have any value and in some extreme cases can drop to zero, unlike money. Gold is a prime example of money as it has always held its value over a long period of time whilst currency can fluctuate.

Why are Currencies Different Around the World?

Different currencies exist because different countries have various economic landscapes. In most cases, a country which exports a lot of goods will aim to have a low-value currency to keep on top of their trade advantage and attract people to buy their products.

Most countries will usually compare their currency to a commonly used currency like the British pound or American dollar and fix their own currency’s exchange rate to this currency. This is done in order to maintain stability for investors, who don’t want to worry about any fluctuations in the currency’s value. If a currency’s value drops, the value of investments will also decrease.

Say you wanted to buy a fizzy drink in the UK, it may cost you £1. However, in South Korea, the same drink would cost you 1,464 Korean Won (KRW) but this doesn’t mean it would be 1,464 times more expensive to buy. If you covert the Korean Won into Pounds, it would roughly cost the same price.

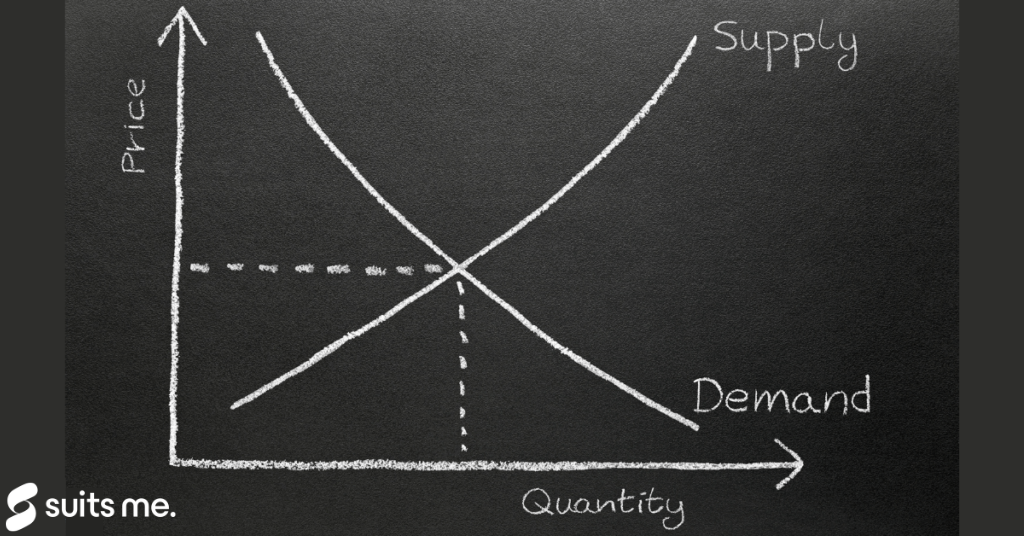

The Supply and Demand for Different Currencies

Any changes in currency are reflected by the supply and demand with currencies acting as a commodity, just like the sale of other goods. The demand for a currency is based on a number of factors including:

- How attractive the country looks to investors – a higher exchange rate will attract foreign investors.

- The prices of certain goods being sold by the country (for example, fuel) – If a company wanted to buy fuel from the UK, they would need to exchange their currency to GBP. If the price of the fuel rises, more money will need to be exchanged, which increases the value of the pound.

- The levels of inflation (the rise in prices of goods and services and the decrease in the purchasing power of a given currency over time) – If a currency decreases in value or power, people will not want to purchase it as it looks less attractive.

How do we Measure the Value of Currency?

Whether it’s the Japanese Yen (JPY) or the Canadian Dollar (CAD) how do we measure the value of these different currencies?

Most of the major currencies across the globe such as the Euro (EUR), Great British Pound (GBP) and the American Dollar (USD) are known as Fiat Money, which basically means they hold their value because people have faith that the currency will accept all around the world.

There are generally three ways to measure the value of a currency. We’ll use the British Pound as an example.

The Exchange Rate

The exchange rate reflects how much the pound will buy in other foreign currencies. This is determined by Forex Traders within the foreign exchange market. They base the exchange rate on supply and demand and future predictions – this is why the exchange rate fluctuates throughout the day.

Treasury Bills (T-Bills)

A bidder will purchase a treasury bill at a discounted rate and will receive payment from the UK Treasury Department when the loan (usually three to six months in length, but no longer than a year) reaches maturity. When the demand for treasury bills are high, the value of the British pound increases as more money is being pumped into the UK.

All of the UK Treasury bills are issued by the Bank of England on behalf of the government on a weekly basis and are traded via the secondary market for Treasuries.

From a credit standpoint, these bills represent the highest quality financial obligations available. Similar to banknotes, these bills are used by experts to measure the short term risk-free rates (the rate of return of an investment with no risk of loss).

Foreign Exchange Reserves

Foreign exchange reserves are foreign currencies held on reserve by a countries central bank, so in the UK these would be held by the Bank of England.

These are essentially backup funds in case a country’s national currency loses its value. Most foreign reserves around the world are held in American dollars as it’s the most traded currency in the world.

What is Meant by the Strongest Currency?

The term “strongest currency” refers to a currency that is worth more than another countries currency. For example, if a British pound was worth half a Euro, the Euro would be considerably stronger than the Pound.

In 2020, the strongest currency across the world is the Kuwaiti Dinar (KWD). Kuwait is a small country between Iraq and Saudi Arabia and their wealth has largely been driven by their substantial oil exports. In comparison, the pound sterling is the fifth strongest currency in the world.

A strong currency means a country can purchase more foreign currency than before and the citizens of the strengthening currency will benefit from cheaper imports and foreign travel. However, it does put foreign visitors at a disadvantage as they won’t get as much value for money when exchanging currencies.

Currency Is Vital in our Economy

All currencies have the same objectives – to encourage economic activity and growth by increasing the value of the market for certain goods, to enable people to store wealth and manage their long-term needs.

Although currency was previously limited to physical banknotes and coins, our modern world has created new forms of digital currencies, like Bitcoin, which exists only as data and kept safe using complex encryptions.

This type of currency will never be made physical but live outside the realm of centralised banks and governments – the advancement of cryptocurrencies could impact the future of traditional currencies but more on that another day.