Pyramid schemes are nothing new and been around for decades but they’re making their way online and invading our social media channels with misleading promises of big payouts in return for your money. Below, we discuss our top tips to help you keep your money safe and advice on spotting a pyramid scheme.

What is a Pyramid Scheme?

A Pyramid Scheme is an unstainable business model, where a few high-level members recruit newer members who pay upfront costs to those who enrolled them. As newer members then begin to recruit people of their own, a part of the fees they receive are also passed but up the chain to higher-level members.

The vast majority of pyramid schemes rely on profiting from recruitment fees and don’t often involve the sale of actual good, unlike Multi-Level Marketing Schemes (MLMs), which are similar in nature to pyramid schemes but involve the sale of physical goods.

Blessing Loom/The Giving Loom

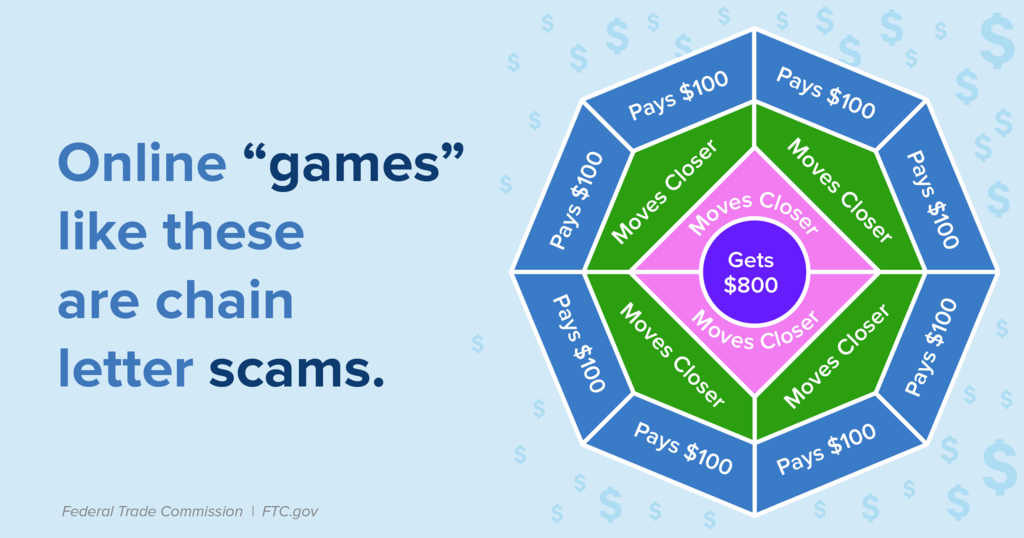

An example of a social media pyramid scheme is the Loom Circle scheme which first became popular on social media in early 2019. The scheme targeted young people on Facebook and Instagram with the promises of free money.

It was cleverly disguised, as a circle rather than a pyramid and every time a new person was recruited, the others were pushed closer to the centre of the circle where they’re promised a large payout.

However, if people are unable to find investors and move closer to the circle, the last people to invest lose their money.

Top Tips to Protect your Money from Pyramid Schemes

Be Suspicious of Uninvited Offers

Someone contacting you unexpectedly is often a red flag. It could be a stranger or someone you went to school with, whoever reaches out, it’s worth being careful.

Investment scams are often targeted at the elderly, however with the evolvement of social media and digital platforms, pyramid schemes are increasingly being aimed at younger people.

Research Promises Free Money or “Get Rich Quick” Claims

If it looks too good to be true, the likelihood, is that it probably is. Disappointing, yes, but it could save you from losing your money.

Although pyramid schemes generally require an upfront cost and initial investment under the premise of quick and high returns, it’s worth being mindful of other scams that usually, come with a catch.

Check Out the Seller

It’s worth checking out the seller to try and see if they’re legitimate before signing up or paying money into any sort of scheme. You should be wary if:

- They’re asking for upfront payment immediately,

- They have thousands of friends or very few,

- Their images do not match or don’t seem to obviously be the same person,

- They’re heavily recruiting across their social media platforms,

- They’re asking for personal payment details such as debit card details or your bank account details,

- They have limited information about the scheme they’re recruiting you for.

However, it’s easy for people to become involved in pyramid schemes – without actually realising they are! So, you should be careful if your friends and family are inviting you to invest money in something that seems too good to be true.

There is an Emphasis on Recruitment

If the investment opportunity heavily focuses on the recruitment of others for a small fee, it’s likely a pyramid scheme. You should be wary of schemes where you will receive more money from recruiting people than the sales of actual products or services.

Invest in Yourself, Not a Pyramid Scheme

The model of profiting by using social media networking, often leads to individuals recruiting their friends and family, which can make people feel trapped and put a strain on relationships.

If you’re looking to invest some money or make some quick cash, you should proceed with caution or avoid these types of schemes all together but remember, before parting with your money, to do your research, investigate the seller and be mindful that “free money” is usually too good to be true.