Withdrawing Money from your Debit Card

You can withdraw money from your Suits Me Debit Card at any Mastercard® ATM located in the following countries:

| Algeria | Andorra | Angola | Antigua and Barbuda | Argentina |

| Armenia | Australia | Austria | Azerbaijan | Bahamas |

| Bahrain | Bangladesh | Belgium | Belize | Benin |

| Bhutan | Bolivia | Bosnia and Herzegovina | Botswana | Brazil |

| Brunei | Bulgaria | Burundi | Cambodia | Canada |

| Cape Verde | Central African Republic | Chile | China | Colombia |

| Comoros | Costa Rica | Ivory Coast | Cyprus | Czech Republic |

| Denmark | Djibouti | Dominica | Dominican Republic | Ecuador |

| Egypt | El Salvador | Equatorial Guinea | Eritrea | Estonia |

| Eswatini | Ethiopia | Fiji | Finland | France |

| Gabon | Gambia | Georgia | Germany | Ghana |

| Greece | Grenada | Guatemala | Guinea | Guinea-Bissau |

| Guyana | Honduras | Hungary | Iceland | India |

| Indonesia | Ireland | Israel | Italy | Japan |

| Kazakhstan | Kiribati | Kosovo | Kuwait | Kyrgyzstan |

| Laos | Latvia | Lebanon | Lesotho | Liberia |

| Libya | Liechtenstein | Lithuania | Luxembourg | Madagascar |

| Malawi | Malaysia | Maldives | Malta | Marshall Islands |

| Mauritania | Mexico | Micronesia | Moldova | Monaco |

| Mongolia | Montenegro | Morocco | Nepal | Netherlands |

| New Zealand | Nicaragua | Niger | North Macedonia | Norway |

| Oman | Pakistan | Palau | Palestine | Papua New Guinea |

| Paraguay | Peru | Poland | Portugal | Qatar |

| Romania | Rwanda | Saint Kitts and Nevis | Saint Lucia | Saint Vincent and the Grenadines |

| Samoa | San Marino | São Tomé and Príncipe | Saudi Arabia | Serbia |

| Seychelles | Sierra Leone | Singapore | Slovakia | Slovenia |

| Solomon Islands | Somalia | Spain | Sri Lanka | Suriname |

| Sweden | Switzerland | Taiwan | Tajikistan | Thailand |

| Timor-Leste | Togo | Tonga | Tunisia | Türkiye |

| Turkmenistan | Tuvalu | Ukraine | United States | Uruguay |

| Uzbekistan | Zambia | Zimbabwe |

Suits Me Premium Plus customers get 4 free UK withdrawals each month, giving you easy access to withdraw money without the worry of additional costs.

Please note: Some ATMs charge a fee for using them. Check this before using the ATM.

Find your Nearest Mastercard® ATM

Find your nearest Mastercard® ATM in two ways;

- Suits Me mobile app. Open the app and before you log in, tap ‘Mastercard® ATM locator’ towards the bottom right of the screen

- Visit the Mastercard® ATM locator website

How to Use an ATM

ATM is an acronym that stands for ‘Automated Teller Machine’.

For a first-time user, they can look very daunting and complex to use. However, they are in fact, very straight forward and easy to use.

Using an ATM is the quickest and convenient way to get cash from your account using your card (debit card, prepaid card or credit card).

Although ATMs are easy to use, you must remember to use them in a safe manner.

There are thousands of ATMs available in the UK, use the ATM finder to find your nearest one.

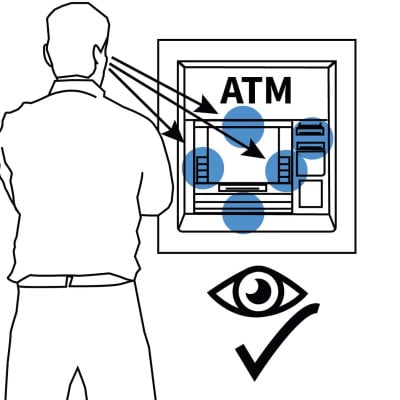

Step 1: Safety & Security First

Before you use an ATM, make sure it is safe to do so first.

They are often a target for thieves and fraudulent activity.

To stay safe;

1. Make sure that no one is close by to the ATM and anyone else in the queue to use the machine is giving you adequate space to be able to hide your personal details.

2. Examine the machine for anything that looks out of place or suspicious, like an added device or hidden camera. Thieves target ATMs by installing hidden skimming devices which they then use to steal card numbers and cameras to watch you enter your PIN.

3. Try not to use ATMs in the evening in a poorly lit area

If anything looks suspicious on the machine that you are about to use, don’t use it. It’s always better to be safe, especially when it comes to your personal details account details and money.

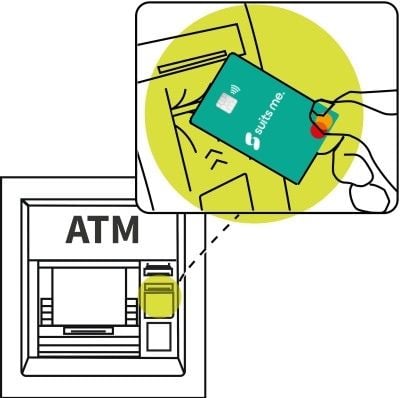

Step 2: Insert your Card

(debit card or prepaid card or credit card)

Once you have made sure that the ATM is safe to use, insert your card into the card reader

Insert your card into the ATM facing up with the chip at the front (see diagram below).

The Majority of ATMs in the UK will hold onto your card until you have finished using the machine.

Note: Some ATMs will take your card into the machine, whereas others only take part of the card.

Step 3: Enter your PIN (Personal Identification Number)

To access your account using your card, you’ll need to prove your identity by entering your PIN.

Keep in mind safety and security from Step 1 and the potential for hidden cameras. When entering your PIN, a good safety method is to cover the keypad with one hand while entering your PIN with the other hand. Note: It is important to remember your PIN, when entering it in at an ATM, for security, you only have 3 tries to get the PIN right. If you enter your PIN wrong on the third attempt, the ATM will take your card for security measures.

Step 4

Choose a Transaction

ATMs offer various services so you will need to select which service you require.

If you wish to use more than one service, for example, view your balance and withdraw cash, some ATMs allow you to do both in one session, whereas others may end your session, return your card and require you to start the process again.

Cash Withdrawals

The most popular and common reason for using an ATM is to take out cash from your account. To make a cash withdrawal, you’ll need to indicate how much you want to take out, this is usually in increments of £10.

Balance Enquiry

Using the Balance Enquiry feature shows you how much money you have in your account. This feature will display your current account balance on the ATM screen.

Pin Services

Many ATMs offer the functionality to change your card PIN. If you have been given a PIN by your provider that you would prefer to change for a more memorable one to you, you can do so at an ATM.

Step 5

Print a Receipt?

ATMs will offer you the option to print a receipt for you to use as a written record of your transaction. In most cases, this isn’t necessary. If, however, you choose the option of having a receipt, be careful with what you do with it as it will include sensitive and personal information. When getting rid of the receipt, it’s best to cut the receipt into pieces and throw them away into two separate bins.

Step 6: Finish

Once you have completed your session at the ATM, make sure you not only have picked up your cash (if you have withdrawn money) but that you also have your card too.

Before moving away from the ATM, make sure that your session has completely ended so no one can enter your account. If you’re unsure, press the cancel button a couple of times.

If you have used the ATM to withdraw cash, for safety, it’s best to place your cash straight into your wallet or purse before walking away.

ATM Usage Top Tips

- Be aware of ATMs with high charges

- If possible, use an ATM that is associated with a bank. These are the larger ATMs that tend to be on the high street and set into buildings, banks and Post Offices. Single standalone ATMs can be a higher target to fraudulent activity and if something happens with your card where the machine keeps it, it often takes longer to get your card back.